How the world’s first cross-border equity crowdfunding deal signals a fundamental shift from platform competition to collaborative infrastructure

The equity crowdfunding industry stands at an inflection point. While platforms have focused on competing for market share within their jurisdictions, a more fundamental challenge has emerged: the need for infrastructure that enables global capital flow without sacrificing regulatory compliance or platform autonomy.

This infrastructure-first approach isn’t new to blockchain ecosystems. Just as Polkadot built interoperability rails for the multi-chain future, and Solana architected high-throughput infrastructure for DeFi applications, the equity crowdfunding sector requires foundational technology that enables collaboration rather than competition.

That’s precisely what Dacxi Chain has been building – and 2025 has proven to be our breakthrough year.

The Infrastructure Imperative

The global equity crowdfunding market, valued at approximately $2.1 billion in 2025 with projections exceeding $5 billion by 2032, faces a structural challenge that growth alone cannot solve. Despite regulatory harmonization efforts like the EU’s ECSPR framework, platforms remain largely isolated, creating inefficiencies that limit both capital access and investor opportunity.

Consider the numbers: research indicates that 50% of crowdfunding campaigns raise minimal amounts, while only 10% achieve significant success. This isn’t primarily due to poor ideas or insufficient capital – it’s a distribution and matching problem. The right investors exist, but fragmented infrastructure prevents efficient discovery and cross-border participation.

The solution requires infrastructure thinking, not platform thinking.

Proving the Concept: World’s First Cross-Border Success

In the first half of 2025, Dacxi Chain completed the world’s first cross-jurisdiction equity crowdfunding deal, connecting UK-based Angels Den with Latvia’s Crowded Hero. This wasn’t merely a technical achievement – it was validation of a fundamentally different approach to global crowdfunding infrastructure.

The breakthrough demonstrated several critical capabilities:

Regulatory Harmony Without Homogenization: Each platform maintained its regulatory compliance framework while enabling seamless cross-border investor participation. This preserves jurisdictional sovereignty while creating global connectivity- a balance that traditional financial infrastructure has struggled to achieve.

Trust Layer Scalability: By implementing blockchain-secured attribution and transparent due diligence standards, we created portable trust that transcends geographic boundaries. Investors could participate confidently in foreign deals without duplicating compliance processes.

Economic Alignment: Smart contract-based revenue sharing ensured that referring platforms earned from cross-border activity, creating sustainable incentives for collaboration rather than competition.

Technical Foundation: Platform 1.0 and Blockchain Infrastructure

While the cross-border deal captured headlines, the underlying technical achievements represent the more significant long-term value creation:

Platform 1.0 Deployment: Our core infrastructure now supports live partner integrations, providing the API framework that enables platform collaboration without platform consolidation. Unlike traditional marketplace models that seek to centralize activity, our infrastructure empowers distributed networks.

Blockchain Architecture: The deployment of our proprietary blockchain infrastructure creates the foundation for immutable transaction records, automated compliance verification, and tokenized equity management – capabilities that will prove essential as the industry evolves toward programmable securities.

Leadership Expansion: The addition of our Chief Product Officer reflects our commitment to scaling technical excellence while maintaining the product focus necessary for complex B2B infrastructure.

Enhanced Token Economics: The operational launch of our enhanced Dacxi Coin [DXI] framework demonstrates practical utility in network economics, moving beyond speculative token models toward genuine economic infrastructure.

Strategic Positioning: GECA Partnership and Industry Leadership

Our strategic partnership with the Global Equity Crowdfunding Association (GECA) positions Dacxi Chain at the center of industry evolution rather than on its periphery. This isn’t simply business development – it’s recognition that infrastructure providers must actively shape regulatory and industry standards rather than merely respond to them.

This approach mirrors successful infrastructure projects across the blockchain ecosystem, where technical excellence combines with active governance participation to drive adoption and standard-setting.

The Road Ahead: Platform 2.0 and Global Expansion

The second half of 2025 will see significant infrastructure expansion that builds upon our validated foundation:

Advanced Tokenization (Platform 2.0): Our upcoming platform will introduce programmable equity capabilities, enabling automated compliance, fractional ownership, and enhanced liquidity options. This represents a fundamental evolution from static equity instruments toward dynamic, blockchain-native securities.

US Market Integration: Extending our infrastructure to support Regulation CF compliance opens access to the world’s largest equity crowdfunding market while maintaining our core principle of local regulatory responsibility with global connectivity.

Accelerated Partnership Growth: With proven technology and validated business models, we anticipate significant acceleration in platform integration and transaction volume throughout the remainder of 2025.

Exchange Infrastructure: Our pursuit of Tier 1 exchange listing for DXI reflects the maturation of our token economics from network utility toward broader market recognition and liquidity.

Industry Implications: From Competition to Collaboration

The success of our cross-border infrastructure suggests a broader shift in how financial technology evolves. Rather than winner-take-all platform dynamics, we’re seeing the emergence of collaborative infrastructure that enables multiple participants to thrive.

This mirrors broader trends in blockchain and fintech, where infrastructure providers like Stripe in payments, Plaid in banking connectivity, and Chainlink in blockchain oracles have created more value by enabling ecosystems rather than competing within them.

For equity crowdfunding, this means:

- Platforms can focus on their core competencies (regulatory compliance, investor relations, local market expertise) while leveraging shared infrastructure for global reach

- Investors gain access to diversified opportunities without navigating multiple compliance frameworks

- Entrepreneurs can access global capital while working through familiar, trusted local platforms

- Regulators can maintain oversight within their jurisdictions while enabling cross-border capital flow

The Complete Picture: Download Our 2025 Progress Report

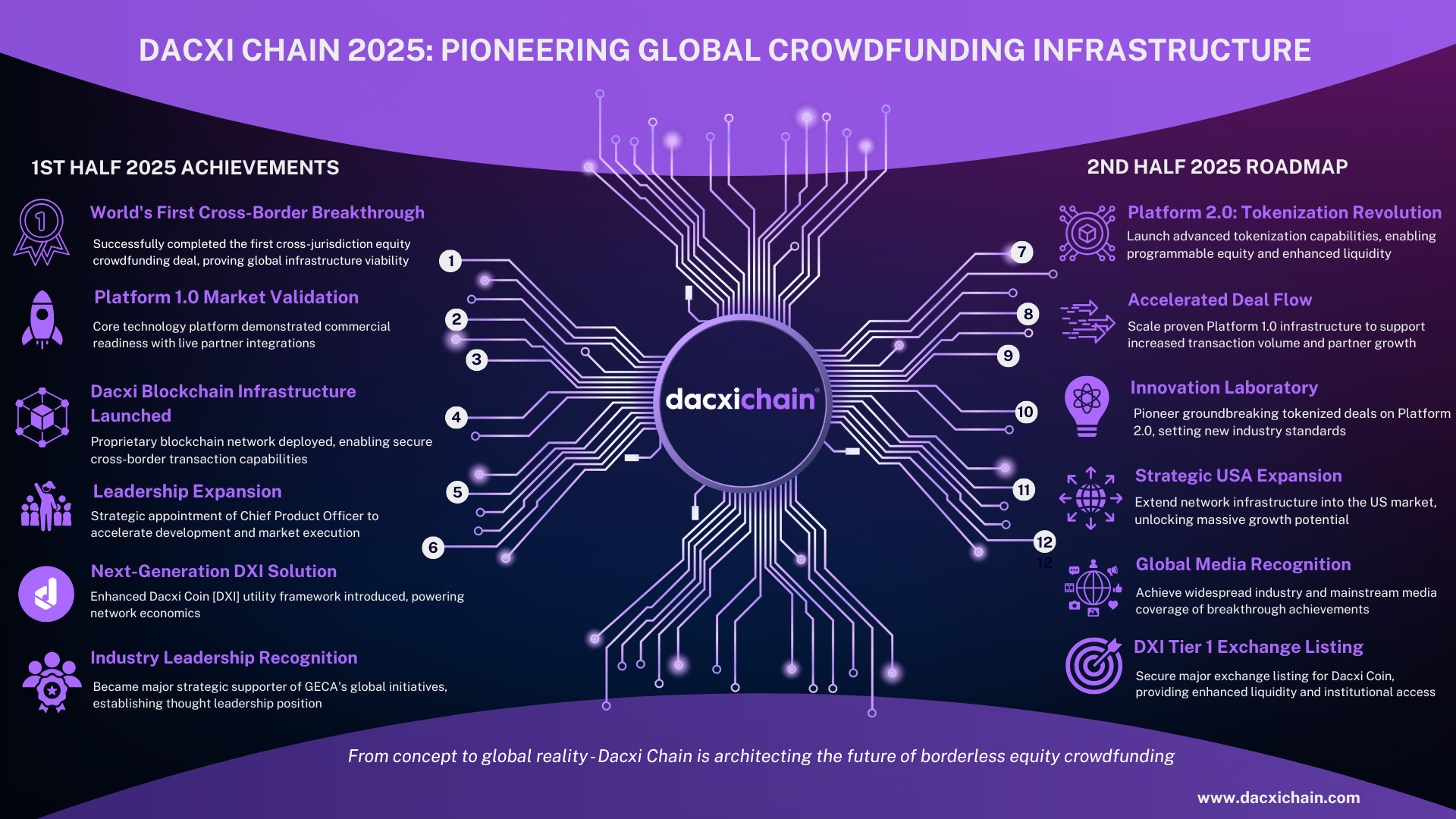

To provide stakeholders with comprehensive insight into our achievements and roadmap, we’ve created a detailed infographic that captures our complete 2025 journey – from breakthrough milestones to future developments.

[Download the full Dacxi Chain 2025 Progress Infographic here]

This resource provides visual representation of our technical achievements, partnership growth, regulatory progress, and strategic roadmap through 2026.

Looking Forward: Infrastructure for the Next Decade

The equity crowdfunding industry is transitioning from early-stage experimentation toward mature infrastructure. Just as the internet required fundamental protocols before applications could flourish, global crowdfunding requires collaborative infrastructure before its full potential can be realized.

Dacxi Chain’s 2025 achievements – from cross-border breakthrough to blockchain deployment—represent foundational infrastructure that enables rather than constrains innovation. As we expand into the US market and launch advanced tokenization capabilities, we’re not just growing our own platform; we’re building the rails upon which the next generation of global crowdfunding will operate.

The momentum is building, and the infrastructure is ready. What remains is scaling the collaborative framework that enables platforms worldwide to participate in truly global capital markets while maintaining their independence, compliance, and competitive differentiation.

For platforms, investors, and industry participants, 2025 marks the beginning of infrastructure-enabled global crowdfunding. The question isn’t whether this future will arrive – it’s whether stakeholders will actively participate in building it.

Interested in exploring partnership opportunities or learning more about our expanding infrastructure? Connect with our team at [email protected] or visit dacxichain.com.

For comprehensive details on our 2025 progress and future roadmap, download our complete infographic using the link above.