Dacxi Chain: Disrupting the VC Market with Blockchain-powered Global Crowdfunding

This article examines how Dacxi Chain is revolutionizing startup financing by disrupting the traditional VC market with its blockchain-powered global crowdfunding network.

Over the past decade, startup financing has experienced a significant transformation. The advent of crowdfunding platforms, angel investors, and syndicate deals has disrupted the traditional venture capital (VC) market and opened up new options for entrepreneurs seeking early-stage funding. In fact, the global crowdfunding market is expected to grow to $43 billion by 2028, indicating the success and popularity of this new era of startup financing.

Leading the charge in this era is Dacxi Chain, a global crowdfunding network that connects investors and entrepreneurs in a streamlined experience. Its revolutionary approach to startup financing has the potential to change the way we think about investing in new ideas. Dacxi’s extensive interoperability network is one of its key benefits. It allows entrepreneurs to reach a wider audience of potential investors from different crowdfunding platforms, making it easier to access the funding they need to grow their businesses.

What sets Dacxi apart is its use of blockchain technology to deliver global crowdfunding and overcome the challenges associated with global funding and investment solutions. By tokenizing shares on the blockchain, ownership issues are solved on a global basis. Cryptocurrency allows for instant global multi-currency investments, tokenized shares allow for a global secondary market providing asset liquidity, and four other blockchain applications enhance the network’s functionality.

Despite all the technological innovations, the true power of Dacxi’s global crowdfunding network lies in its ability to provide a trusted solution for raising capital and investing globally. Its decentralized nature means local platforms are regulated, ensuring the crowd can trust that they will be supported.

“Crowdfunding and blockchain technology are two of the most disruptive forces in modern finance. By combining these two innovations, Dacxi Chain is shaking up the traditional venture capital market and paving the way for a new era of startup financing. With our blockchain-powered global crowdfunding solution, we’re making it easier than ever for entrepreneurs to access the funding they need to turn their ideas into reality. Dacxi Chain is not just a network, it’s a movement that’s changing the way we invest in new ideas and democratizing access to capital.” – Fernando Pacheco, Chief Product Officer at Dacxi Chain.

Final Thoughts

Dacxi Chain is disrupting the VC market by providing a viable pathway to funding through its global crowdfunding network. Its use of blockchain technology ensures transparency, security, and efficiency in the crowdfunding process. Entrepreneurs can tap into a wider pool of potential investors, making funding more accessible than ever. Dacxi is at the forefront of the transformation of startup financing and is poised to change the way we invest in new ideas, paving the way for a new era of startup financing.

Dacxi Chain's Global Crowdfunding Network: Revolutionizing Early-Stage Funding for Niche Industries

This article explores how Dacxi Chain’s global crowdfunding network facilitates the scaling of crowdfunding businesses, granting niche industries access to a larger pool of domain-knowledgeable investors.

The Benefits of Crowdfunding

The advent of crowdfunding has revolutionized the way startups and entrepreneurs raise capital. It offers access to a broader pool of potential investors, democratizing the process and providing more options for entrepreneurs to secure funding. However, scaling crowdfunding remains a significant challenge, particularly in niche industries that require specialized knowledge to invest with confidence.

Dacxi Chain’s Solution

Dacxi Chain’s global crowdfunding network aims to address the scaling challenges in specialist crowdfunding segments. By networking all the crowdfunding companies together, a global network of independent crowdfunding companies will have access to hundreds of thousands of sector specialists. This network effect enables the scaling of crowdfunding businesses, providing specialist segments, such as biotech, with access to more investors who understand their technology.

The Due Diligence Issue

One of the challenges of crowdfunding is due diligence. Venture capitalists have the luxury of spending time with executives and analyzing all the facts about a company. Crowdfunding investors, on the other hand, must rely on the crowdfunding platform to conduct due diligence, which may not be enough for them to invest confidently, especially if they lack domain knowledge.

Dacxi Chain’s Unique Advantage

This is where Dacxi Chain’s global crowdfunding network provides a unique advantage. Dentists will understand dental opportunities, farmers will understand agricultural opportunities, and e-commerce professionals will understand e-commerce opportunities. These specialists do not require much information to analyze the business opportunity, making the rest of the deal much more straightforward. The global network of independent crowdfunding companies will have access to hundreds of thousands of sector specialists, making it easier for them to analyze business opportunities.

Ian Lowe, CEO of Dacxi Chain, on the Power of Networks

“At Dacxi Chain, we believe in the power of networks. By connecting crowdfunding companies around the world, we are able to tap into a vast network of specialist investors who understand specific industries and can help to scale early-stage funding for growth businesses. Our global crowdfunding network is designed to make the process of raising capital more accessible, faster, and more efficient for entrepreneurs who are seeking to take their businesses to the next level.”

Final Thoughts

Dacxi Chain’s global crowdfunding network addresses the scaling challenges in specialist crowdfunding segments by connecting all crowdfunding companies. The network effect of being connected to other crowdfunding companies worldwide allows for the scaling of crowdfunding businesses, giving specialist segments, such as biotech, access to a broader pool of investors who possess the domain knowledge to invest confidently. With Dacxi Chain’s innovative use of web3 and blockchain technology, global crowdfunding is set to become more efficient, faster, and better scalable, revolutionizing early-stage funding for niche industries.

The Network Effect of the Dacxi Chain

Dacxi Chain is a global crowdfunding network that aims to make raising capital more accessible, faster, and more efficient. This article explores how it can scale crowdfunding businesses through network effects.

Crowdfunding has become an essential source of funding for businesses around the world. It allows entrepreneurs to raise capital from a large number of individuals who are interested in their ideas and products. However, crowdfunding can be a challenging and time-consuming process. That’s where Dacxi Chain comes in. Dacxi Chain is a global crowdfunding network that aims to make the process of raising capital more accessible, faster, and more efficient. In this article, we will explore how the Dacxi Chain network can scale crowdfunding businesses using the network effect of being connected to other crowdfunding companies globally.

Part 1: The Network Effect of Crowdfunding

The network effect is a phenomenon where the value of a network increases as more users join it. This applies to crowdfunding because the more crowdfunding companies that are connected to the Dacxi Chain network, the more valuable the network becomes for both investors and businesses seeking funding. With more companies on the network, investors have access to a larger pool of investment opportunities, and businesses have access to a larger pool of potential investors.

The network effect can also help to increase the speed and efficiency of crowdfunding campaigns. As more investors and businesses join the network, the process of matching investors with businesses becomes faster and more automated. This can help to reduce the time and cost of running a crowdfunding campaign.

Part 2: The Benefits of a Global Pool of Investors

The Dacxi Chain network can connect businesses with investors from all over the world. This provides a number of benefits, including access to more capital and a wider range of investment opportunities. With a global pool of investors, businesses can raise more money and diversify their investor base.

The network can also help to facilitate cross-border investments and make it easier for businesses to expand globally. For example, a business in the United States could use the Dacxi Chain network to connect with investors in Asia or Europe. This could help the business to expand its operations and tap into new markets.

Part 3: The Benefits of a Global Pool of Ideas

The Dacxi Chain network can also connect businesses with other crowdfunding companies from around the world. This creates a global pool of ideas, including access to new markets, technologies, and business models. This can help businesses to innovate and stay ahead of the competition.

The network can also facilitate collaboration and innovation among crowdfunding companies and their clients. For example, a business on the network could collaborate with another business on a new product or service. This could help to bring new ideas to market faster and more efficiently.

Part 4: Scaling Crowdfunding Businesses with the Dacxi Chain Network

The key benefits of the Dacxi Chain network for crowdfunding businesses include access to a global pool of investors and a global pool of ideas. This can help businesses to raise more money, diversify their investor base, and innovate more quickly.

The network can also help to lower the costs and risks of crowdfunding campaigns. By automating the matching process between investors and businesses, the network can reduce the need for manual processes and lower the costs of running a crowdfunding campaign.

Conclusion:

In conclusion, the Dacxi Chain global crowdfunding network offers numerous benefits for businesses looking to raise capital and grow their operations. By connecting businesses with a global pool of investors and ideas, the network can help businesses to innovate, diversify their investor base, and expand into new markets. We encourage readers to explore the Dacxi Chain network and discover its potential for themselves. With the network effect in full force, the future of crowdfunding looks bright.

The Dacxi Chain and Dacxi Coin in 2023

2022 was the catalyst year for the Dacxi Chain.

By the beginning of 2022, it was clear that the tokenization of financial assets using Blockchain technology was being embraced by every major financial institution and government around the world.

This transformational technology will fundamentally change how we own, trade, and secure all financial assets. From shares on stock exchanges to bonds, funds, and patents, right through to precious metals and unlisted company shares. So now, the discussion has turned to where and how to apply the technology, and what solutions we can derive from it.

What does this mean for the Dacxi Chain?

For us, the evolution to mainstream acceptance allowed us to refine our thinking from our original strategy, which was first conceptualised back in 2017. Now, rather than launching the Dacxi Chain’s crowdfunding platform in different countries with different partners, the Dacxi Chain will create an interoperable ecosystem of established licenced equity crowdfunding platforms around the world. This creates the world’s first global crowdfunding network.

A decentralised approach like this is simpler, faster, and smarter. It allows equity crowdfunding organisations to focus on growing their own business by plugging into a global investor network. As a result, equity crowdfunding companies will be allowed to secure more deals with greater velocity, and access growth capital at a significantly greater scale.

What does this mean for Dacxi Coin?

The interoperability of our crowdfunding platform partners creates a global ecosystem. This ecosystem will be powered by our native cryptocurrency, Dacxi coin. It’s Dacxi Coin that holds the value of the ecosystem. We’ve invested years of effort into pioneering the unique technology that allows crowdfunding platforms around the world to connect with each other and interact. It’s a network that requires speed, simplicity, and most importantly, security. This enables it to deal with investors and issuers from different countries around the world, each with their own unique currency, language, rules, and regulations.

2023 will be a foundational year for the Dacxi Chain.

We already know there are a vast number of great businesses looking for investment. And there are as many as 100 million investors looking to invest in high-growth, high-potential private companies. And 2023 will be a big year for all of them. This year, we will:

- Name our foundation partners and launch the platform

- Announce and execute the first deals via the platform

- Establish the Dacxi Chain as the world leader

- And finally, create strong growth momentum.

The Dacxi Chain will not deal directly with each individual investor or issuer. Rather – much like the old Intel Inside powered the PC revolution – the Dacxi Chain will power the entire ecosystem.

We are under no illusion as to the challenge of building this global network.

Every potential crowdfunding partner can see the global scale we can offer, which would otherwise be unachievable. But every partner also has unique requirements. 2023 will reveal those requirements and the challenges of meeting them. Fortunately, we have a very experienced team – more than capable of handling these complexities and more.

2023 will reveal the true future potential of global crowdfunding.

We believe that the future holds thousands of deals, millions of investors, and billions of dollars worth of investments. How? With the Dacxi Chain – which will use blockchain to tokenize share ownership, and use Dacxi Coin to create a secure global payment system between investors and issuers.

We cannot accurately predict year-end numbers for 2023. But we’re very confident in a successful launch, and look forward to another year of establishing our growth trajectory and proving our leadership. Together, this provides the intrinsic value that underpins Dacxi Coin. We expect to list Dacxi Coin on tier-one exchanges this year. This makes 2023 the Dacxi Chain’s – and Dacxi Coin’s – most important and exciting year yet.

As for me? I’m really looking forward to sharing more major announcements and keeping you updated throughout the year. Thanks so much for reading, and here’s to a bright and successful 2023.

Best regards,

Ian Lowe, Dacxi CEO

At the beginning of the year, it’s become a Dacxi tradition to share what we expect for the year ahead in each part of the business. And as our community and investor base continues to grow, we’re pleased to share our long-term 2023 view for the Dacxi Chain and Dacxi Coin.

Dacxi Chain: A look back at 2022

We had a strong year in 2022, establishing many foundational activities and partnerships for the Dacxi Chain. CEO, Ian Lowe shares some accomplishments for the year and our ambitions for 2023.

As we near the end of what has been an otherwise tumultuous year in crypto, we wanted to take a moment to celebrate not just our resilience but the incredible progress we’ve made at Dacxi Chain in 2022 and share our excitement for what’s to come in 2023.

Dacxi Chain Launch and Leadership

As you may know, after five years of hard work from many talented and passionate people, we’re on the cusp of launching our groundbreaking project, Dacxi Chain, which will pioneer and lead the charge in Global Crowdfunding.

For those unfamiliar with crowdfunding, equity crowdfunding is a capital-raising strategy used by early-stage companies to raise capital by selling shares to a large pool of retail investors, while blockchain technology helps facilitate this process by tokenizing shares and allowing for global distribution.

With our team of experts and cutting-edge technology, we expect to have developed a strong network of crowdfunding partners by the end of 2023, making Dacxi Chain the leader in the industry. This development was no mean feat, and we should all be proud of what we’ve achieved, because what comes next will be truly groundbreaking.

Educational Resources

In addition to our work on Dacxi Chain, we have also made significant updates to our online presence and educational resources. Our new website, Dacxichain.com, features our latest whitepaper and litepaper, and we will soon be releasing the inaugural Global Crowdfunding Regulatory Report for 2023. We have also been hosting monthly updates and educational webinars, with recordings available for those who were unable to attend.

Our community for Dacxi Coin continues to thrive, with over 100,000 members on social media platforms like Twitter and Telegram — please do join us if you haven’t already, we are always eager to answer questions and provide support.

Equity Crowdfunding Week 2022

In November, I attended Equity Crowdfunding Week in Los Angeles. Speakers at the conference shared their insights on the future of investing. It was a tremendously exciting and affirming experience that confirmed that we are at the right time and right place with the Dacxi Chain. You can read what the experts said and why the Dacxi Chain perfectly aligns with their vision here. You can watch my video broadcast from the event here or listen to my interview on the ‘Unleashed’ podcast here.

Our Dacxi Development Team Gathered in London for a Global Summit

As we head into 2023, the Dacxi dev team is working hard to bring the Dacxi Chain to the world. We continue to build on commercial partnerships, as well as strengthen our product offering. Last month the dev team came together from all over the world, including Brazil, Australia and the UK for a collaboration meeting. The main agenda of this meeting was to discuss our protocols, roadmaps, and basically all things Dacxi Chain related. This was, in fact, one of the few times where many of the members actually were able to meet face to face despite being all around the globe. Product Officer Fernando Pacheco shares his reflections from this summit. You can hear it here.

Dacxi Coin

The Dacxi Coin is the native cryptocurrency of the Dacxi Chain and has the potential to become a top 20 cryptocurrency by value, due to its primary use as the transactional currency for moving investments globally from investors to deal issuers. Unlike so many other crypto-coins, Dacxi Coin has a clear use case in one of the most important sectors of the Tokenized Asset sector.

As the leading project in the rapidly growing tokenized asset sector, which is predicted to become a US$1 trillion sector according to organizations like HSBC, IBM, and the RBA, we expect the Dacxi Coin to gain significant market interest with the launch of our chain and further listings.

As we enter 2023, we have high expectations for the future of Dacxi Chain and the impact it will have on the world of innovation funding. By democratizing investments and providing wealth-creating opportunities to people around the globe, we hope to bring hope and opportunity to communities everywhere.

Thank you for your support and we hope you have a wonderful New Year celebration.

Best regards,

Ian Lowe, Dacxi CEO

Wefunder - Vote with your dollars on the future you want to see

Wefunder - Vote with your dollars on the future you want to see

When most people say “crowdfunding,” they think of Kickstarter. But investors in a Community Round are getting equity in the companies they’re investing in through the Wefunder platform. You can call Wefunder rounds “equity crowdfunding” or “investment crowdfunding.”

Music courtesy of BlackIrisFilms.com

Share this article

INTRO

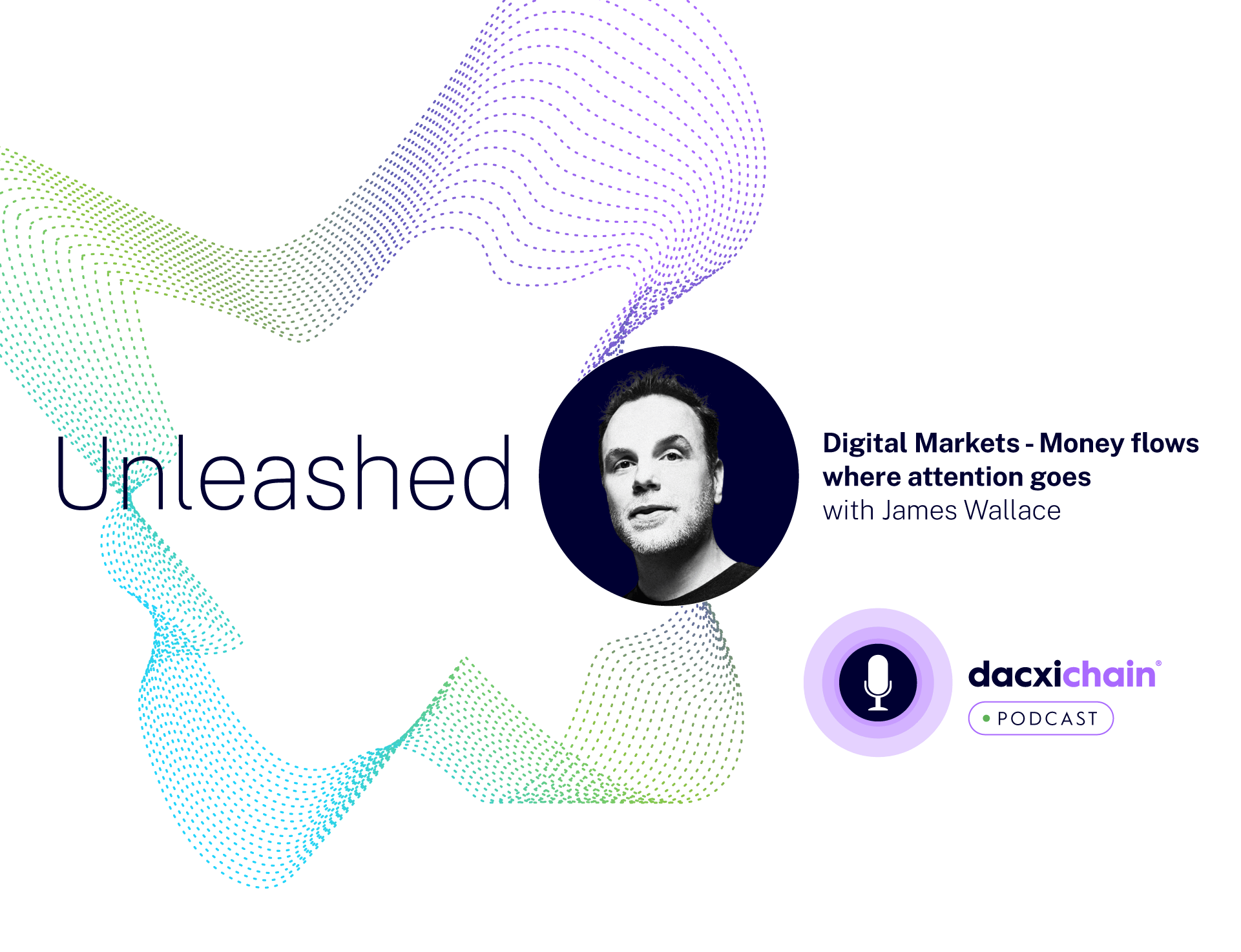

You’re listening to Unleashed with the Dacxi Chain, hosted by Andy Pickering.

Hi folks, it is Andy here. Welcome to Unleashed with the Dacxi Chain, a Dacxi podcast where we learn all about the Dacxi Chain and the incredible opportunities it unlocks. Let’s get on with the show.

Hey, folks. Andy here. Welcome to Unleashed with the Dacxi Chain, the podcast that features experts from within Dacxi and from across the global crowdfunding industry who are here to share their insights on developments shaping indeed the global crowdfunding economy. We have a fantastic guest on the show today. His name is Jonny Price. He is the VP of fundraising at WeFunder. And welcome to the show, Jonny. Just before we dive into the wonderful world of crowdfunding and WeFunder, let’s hear a little bit about yourself, Jonny. Just give us a quick introduction to yourself and your professional story in the lead-up to WeFunder.

GUEST INTRO

Yeah, for sure. I’m from England originally. You might be able to tell from the accent, even though I’m talking to you from Nashville, Tennessee in America. These days I live here, but from the UK, originally. Out of college, found my way into management consulting for my sins. Did that for six years. Partway through that I came to volunteer at a nonprofit called Kiva.org in San Francisco. And this was a crowdfunding platform for micro-loans, the micro-entrepreneurs around the world, mostly in the developing world. And so volunteered there for a few months in San Francisco, and met my wife, which is why I moved back to San Francisco permanently. And then in 2011, I joined Kiva full-time, left consulting, and joined Kiva full-time to launch their US lending program. So Kiva was known for lending to micro-entrepreneurs in Africa and South America, and I led the team to bring that model to support mom-and-pop shops in the US. A barber shop or a small-scale family farm, borrowing $5,000 from 200 people, lending $25 each. So grew that team for seven years and then in early 2018 joined WeFunder. And so I’ve been here now for five years. I lead our fundraising team. And yeah, basically our vision as I’m sure we’ll talk more about is helping more founders access capital and enabling ordinary people as well as millionaires and billionaires to invest in startups they love.

ANDY’S COMMENTS

Awesome. Thank you, Jonny. And yeah, let’s start to do that then. So WeFunder, of course, enables anyone really to invest in startups and of course, enables those startups to access capital. Give us a little bit of a sense of how WeFunder works, what the vision is, how long you’ve been going, and the kind of scale that you’ve achieved, Jonny.

PRICE’S COMMENTS

Yeah, sure. So we were founded back in 2012. 1st thing our founders had to do was to change the law. So for 80 years, the securities laws of the US didn’t allow unaccredited investors to invest in startups. The SEC said you had to be an accredited investor, kind of basically a millionaire to invest in startups. And so, yeah, in 2012, Congress passed the Jobs Act and the SEC rolled out regulation crowdfunding, which is part of the Jobs Act in May 2016. And so since May 2016, the last 60 years, everyone’s been able to invest in startups here in America. Not just the richest 5% of the population that is accredited investors. So it’s been a ten-year journey since we started the company to where we are today. We funded $500 million to about 1000 companies. So roughly half a million dollars per company that raise that half a billion dollars have been funded by hundreds of thousands of investors investing in companies through the platform. And our mission and kind of what we’re all about as a company, we are a public benefit corporation, so we’re a pretty mission-driven organization. We’re a B corp as well. And so we have kind of a two-sided mission. Right? So on the founder side, we want to get more capital flowing to startups. We think if we allow everyone to be an angel investor, not just the richest 5% of the population and if we empower more women to invest in startups and more angel investors of color. I live in Tennessee. 80% of venture capital dollars in America go to three states California, New York, and Massachusetts. And so again, if we can empower more people to be investing in states like Tennessee in the middle of the country, hopefully, we can get more capital flowing to founders, especially founders that might historically have been underrepresented. So that’s on the founder side of the equation and then on the investor side of the equation, the idea is let’s let everyone participate in the wealth that’s being created by startups, not just rich people, right? So what if at Uber’s IPO, instead of JasonCalicanus making $100 million and kind of some VCs and millionaires making money, thousands of drivers had become millionaires at Uber’s IPO? These days, more and more wealth is being created before the IPO rate. And if the only people that get to benefit from that wealth creation are rich people, then we believe that’s kind of another force for the concentration of wealth and kind of growing wealth and equality. So our vision is let’s let everyone participate in that wealth creation by investing in the early rounds of startups. So that’s kind of on the investor side, what we’re all about here at WeFunder.

ANDY’S COMMENTS

Yeah, I think that’s a really important point, Jonny, and very much agree with you. That is what the Dacxi Chain is all about as well. Really trying to lower the barriers to investing for all kinds of everyday people all around the world and give them access to those opportunities. The ability to invest in innovation. And there really is a potential kind of social good side to crowdfunding investing as well, right, Jonny?

PRICE’S COMMENTS

Yeah, totally. And I’ll kind of highlight two aspects of that, right? One is we think it’s really cool, especially for consumer-facing companies, if you can engage your customers as investors, they’re going to be more loyal customers, right? Their LTV goes up, their Net Promoter Score goes up, and they’re going to tell all their friends about it. And so there’s like a benefit that you get when you turn customers into owners from a revenue perspective and a growth perspective, as well as obviously being able to raise additional capital through WeFunder. And then the second point I was going to make escaped me. Hopefully, that will come back to me.

ANDY’S COMMENTS

All good. I’d love it if you could just give us a sense of how fast the global crowdfunding industry has moved, Jonny, because you will have been, even if not there from the beginning. You’ve been a participant for a long time and working inside the industry, of course, because crowdfunding really didn’t exist until, I don’t know, a decade ago, and now it is a big global movement.

PRICE’S COMMENTS

Yeah. So I think when you talk about crowdfunding, right, there are different varieties of crowdfunding. So when most people think about crowdfunding, they’re thinking of Kickstarter, right? Don’t know when Kickstarter came into being, maybe in 2005. What we’re doing at WeFunder it and there’s like, go fund me, right, which is like donations-based crowdfunding. And what we’re doing at WeFunder is investment-based crowdfunding, right? Most of it is equity. Probably 95% of the investment volume on the platform is equity. We actually do allow for debt-based crowdfunding as well. So, for example, there might be a brewery that’s raising a loan and can raise that from their customers, but most of what we do is equity. But yeah, so WeFunder is about investment crowdfunding. Our kind expectation is that investment crowdfunding becomes a much bigger industry than perks-based crowdfunding. I actually don’t know the stats. I believe we’ve already passed perks-based crowdfunding, but don’t quote me on that. But if you’re offering a rate of return, potential rate of return to investors, then our expectation is you’re going to be able to raise a lot more capital. And so hence the investment volume through investment crowdfunding, we think will be a lot higher than it is through Kickstarter. And you see that the average campaign on WeFunder raises half a million. The average Kickstarter campaign I believe is 25K. The average investment amount on WeFunder is $1,000 versus $80 for Kickstarter. So I think investment crowdfunding will be a much larger industry than perks-based crowdfunding or donations-based crowdfunding. In terms of the market size for investment crowdfunding, it’s still pretty small. So this year, I think regulation crowdfunding in the US will do about 500 million. Regulation Crowdfunding is the exemption where you can raise up to $5 million per year. It’s more for the kind of early-stage startups. And then there’s another exemption called regulation A+ for larger companies where you can raise up to 75 million. The market size there is a little fuzzier, and there’s a little less stage on it, but for Regulation crowdfunding this year, I think we’ll come in at about 500 million. And that’s a drop in the ocean of early-stage angel investing, you know, Early stage capital for either MainStreet businesses or tech startups. If you look at venture capital dollars, seed StageSeries AB which is really the sweet spot for WeFunder, the Friends and Family Round Capital, that 500 million, that’s the reg CF industry of which WeFunder is about 40% market share right now. So with the leading platform in terms of investment volume, but that’s still a really small market share, I would guess kind of 0.1%. Again, the data on the kind of angel investing in the VC market is pretty spotty but my guess would be 0.1% market share. And so that’s our vision over the coming decade, right, is how do we grow that 0.1% to 10%? How do we make it so that especially if you’re a consumer-facing company every round, as well as raising from VCs, right, this isn’t either or thing? Have a VC lead the round, price the rounds, but then open up an allocation of maybe 10%, or 20% of the rounds to let your customers invest. And whether that’s your Friends and family rounds, seed rounds, Series A-B-C-D-E-F-G every consumer-facing company should want to do this because it’s just becoming more and more the norm and expectation that why on earth would you not let your customers and community invest? That’s just going to basically increase their loyalty and increase their feeling like they’re a part of the team. They feel kind of tied to the brand, part of the community. And so the world we’re trying to build is somewhere in a few years’ time every B to C company is letting their customers participate in every round.

ANDY’S COMMENTS

I love it. Sounds fantastic. Jonny, talk us through the, I suppose investor journey. If the website for Wefunder is simply Wefunder.com and you can go along to the website and then you can see all the different kinds of startups or companies that are on there. There are categories just on the front page there are Moonshots, Y Combinator Startups, Entertainment, Main Street, Biotech, and then, of course, you can filter it down by female founders, minority founders, and virtual reality. So there’s a huge variety of different startups. There is something that would appeal to most people.

PRICE’S COMMENTS

Yeah, definitely. One of the cool things about WeFunder, one of the things I love about my job is that we’re working with bars and restaurants and soccer clubs and movies and Main Street businesses as well as tech companies flying cars, moonshots, as you say. And so yeah, there really is, whatever your passion, that’s our vision is that a startup in that space can invite their community and people that are passionate about what they’re building to be a part of the journey.

ANDY’S COMMENTS

And I also appreciate that on the website you’re honest about the risks I suppose you describe a new kind of stock market unlike the Nasdaq, we’re meant for startups and small businesses and then you talk through some of the differences. So you can explain some of these differences, Jonny, but the first one, as we say, is it says it’s much riskier. Never invest more than you can afford to lose. Startups are hard. Even the best founders fail. So maybe talk us through I don’t know if you kind of track the success rates or not, but just talk about what the likelihoods are of each of these individual startups achieving and what happens to the ones that fail and so on.

PRICE’S COMMENTS

Yeah, we always like to try to flag the risk to investors. And it’s not just the riskiness of these investments, right? Like investing in early-stage startups, a lot of those are going to go to zero. Maybe most of those investing at the seed stage is going to go to zero. But also it’s the liquidity, right? So this isn’t the stock market where you can invest $1,000 today, and then if the share price drops 10%, you can sell it for $900 next week. You invest $1,000 in a stock, on WeFunder that might be locked up for ten years, and maybe you get 20 extra ten one day when the company IPO is acquired, but much more likely, that will go to zero. And so we always try to flag the risks. The SEC has put limits on how much investors can invest through WeFunder or through any regulated crowdfunding platform. So anyone can invest $2,200 per year and then that number goes up based on your income and wealth. There’s like a formula that determines how much people can invest. So the SEC is obviously nervous about people not investing kind of more than they should in these pretty risky early-stage startups, and we try to flag that as well. The vision for us we talk about on the website. You’ll see this in our brand. It’s not investing in startups to make a ton of money. It’s investing in startups you love. So our vision is like investing in a company that you love. Maybe you’re a customer of, you love the brand, you love the product. Maybe you know the founder. You believe in the founder. You want to show that you believe in the founder by investing in them. Maybe it’s a cause you care about. There’s a company, Leah Labs went through Y Combinator and then launched on WeFunder. They’re, they’re trying to cure cancer in dogs. And they had, you know, hundreds of investors. And there’s a place on WeFunder. One of my favorite things to do, you can read the notes that investors write and say so many of these investors were writing notes like, my dog died of cancer. If I can be a part of a solution, say that we eradicate canine cancer. I would love to do that. Right? We had this company, Atom Limbs, that’s making better prosthetic limbs. There are 5 million on the platform and so many of their investors, thousands of people writing messages like I was in the armed forces, my colleague lost a limb serving their country. Again, if I can kind of be a part of bringing a product to market that helps their quality of life, that’s something I want to be a part of. Lil Libros is a company founded by two Latino women, who raised a few million dollars on the platform. I think they had 6000 investors and thousands of them. Great comments. They were trying to allow for more representation of the Latino community and kids’ books. They were like, we’re fed up with our kids reading books with no Latino characters in them. And so they set up this kind of publishing company and all of the messages were Latino women saying, this is so awesome, I’m so glad to be a part of it. I really believe in your mission and we need more representation in the books that my kids are reading. That is what WeFunder is all about, right? People investing in causes they care about and people they believe in, as opposed to yeah, investing to make tons of money.

ANDY’S COMMENTS

Yeah. Very well said, Jonny. And you say it really nicely on the website. I think this is a nice way of saying it. You kind of say startups can win big or they can go bankrupt. A good way to consider investing in them is to think of them as similar to socially good lottery tickets. At Dacxi Chain, Jonny, we’re trying to pioneer a new model for global fundraising. And it’ll be a fully regulated global ecosystem where investors all around the world have access to these opportunities. And of course, founders with innovative ideas who need funding can access this global investor pool and we’re going to use blockchain to tokenize these equity shares. So one of the advantages of that, of course, is people can invest in smaller amounts or bigger amounts, whatever they wish, depending on the jurisdictions in their part of the world. And then another advantage of that tokenization system is it enables more liquidity and helps to solve that liquidity problem, Jonny, by launching a second specialist secondary market where people can sell their tokens. This is kind of the vision for the future of the Dacxi Chain. What do you think of that model?

PRICE’S COMMENTS

Yeah, I love the idea of the kind of internationalization. Obviously, there are a bunch of regulations that you guys need to work through, but I love the vision of this. WeFunder is actually expanding in the EU. And so the idea that EU investors get access to American investment opportunities and vice versa, love that idea. Obviously, again, need to kind of think through the regulatory kind of compliance aspects in every country and yeah, on the liquidity side we also kind of, I think to a degree, there’s kind of the ability to get liquidity in terms of secondary transactions with a regular boring old database. Which is what WeFunder currently uses, and suddenly don’t have any plans to move it to the blockchain, maybe down the line. And there are probably some functionality benefits that from a liquidity and secondary perspective that come with it being on the blockchain. But we definitely do have plans to build a secondary market. One of our competitors, Start Engine, actually has a secondary market for Rxcf. We don’t see much liquidity right now, or much kind of demand for secondary, which is why we haven’t kind of prioritized building that ourselves at this stage, but we definitely kind of see that in the future.

ANDY’S COMMENTS

Fantastic. All right, well, as we start to finish off Jonny, please tell the listeners where they can find you online. Perhaps you’re on Twitter, or perhaps you are on LinkedIn. Again, tell people where they can go to learn more about WeFunder and just if there are any thoughts you have on the future of where all this is going that you’re prepared to share. What do you see coming down the line across the next five years or so? Yeah, please take it away.

PRICE’S COMMENTS

Yeah. Jonny Price on LinkedIn. J-O-N-N-Y Price. And then Jonny C Price on Twitter. Obviously, feel free to check out WeFunder. If you go to Wefunder.com, you can browse 300 startups that are raising right now. If you’re a founder looking to raise capital and you want to let your community and customers invest as well as rich people, we’d love to hear from you. There’s an easy place where you can go and just start an application. We’re a pretty open platform. We don’t want to be another VC picking winners and losers. If there’s a coffee shop in rural Wyoming that wants to raise 50K from their customers, we want to let them. So, yeah, hopefully, we can help some of your listeners here, Andy, who might be looking at raising capital. Right now we’re just in the US, but we are expense the EU soon. So, yeah, if you’re listening from the EU and you’re looking at raising capital, we’d love to hear from you as well. And, yeah, in terms of the future, I think I would just kind of go back to what I said earlier. I mean, obviously, we want to grow this thing. We think there’s very much room for us to grow into. And the world, yeah, the world we’re trying to build is one where in a few years’ time, especially B to C founders, can work for B to B as well. Can work for Biotech Buglier lab. It doesn’t have to be B to C, but especially for consumer-facing companies. Like every round, let your customers invest alongside VCs. They can lead the round, but let your customers invest. That’s A, going to accelerate your growth by turning customers into supercharged fans, but also B, it’s the right thing to do. If you build a big company, if you succeed in your mission, you have a nice exit, and you make money for your investors. Wouldn’t it be cool to make some of your earliest supporters and champions and customers money as well as the VCs and angels that are lucky enough to invest in you? So that’s the vision. And, yeah, we’re all on the WeFunder team working hard to kind of bring that future into the present.

ANDY’S FINAL COMMENTS

Awesome. Thank you so much for sharing your thoughts, Jonny, and thank you for coming on the show. Been a pleasure talking to you. All the best and bye for now.

That was Jonny Price from WeFunder. Very successful crowdfunding platform, of course, in the US. And as we’ve learned, they’re moving to establish in the EU as well. And yeah, so I hope you enjoyed that. I certainly enjoyed talking to Jonny. Love some of the phrases that we learned. Consider investing in startups more like socially good lottery tickets and like, that where your attention goes, your money flows. Or where your money flows, your attention goes. Yeah. Saying the same thing in different ways. Thank you for listening to today’s episode of Unleashed with the Dacxi Chain. Don’t forget to subscribe to the podcast in whatever podcast app you are using. Give us a five-star rating on Spotify or Apple podcast. That would be excellent. We always appreciate it. But yeah, that’s today’s episode, team. Thanks for listening and bye for now.

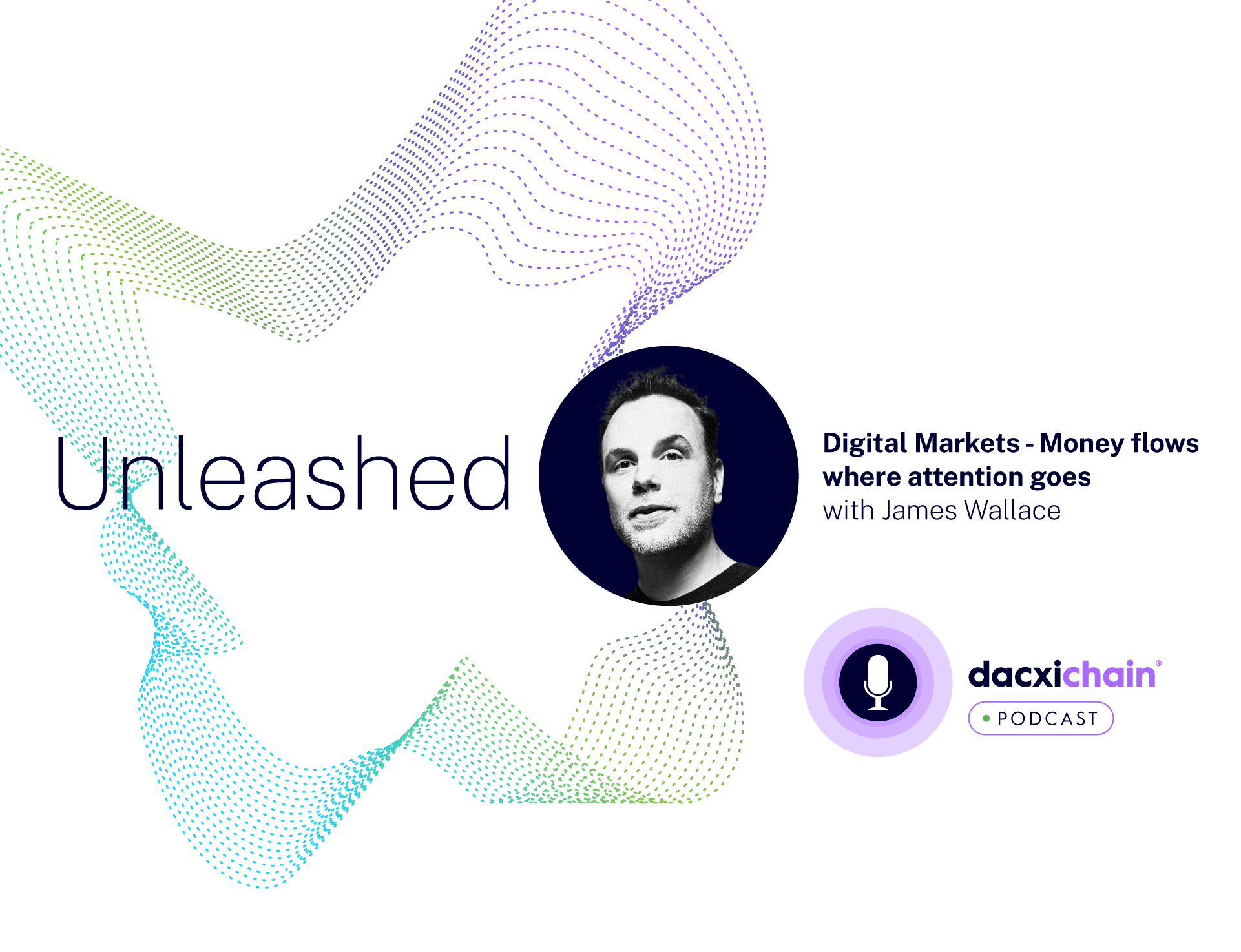

Digital Markets - Money flows where attention goes

Digital Markets - Money flows where attention goes

Andy talks with James Wallace, Chair of Digital Markets – a platform that connects the world’s best assets with global investors through a network of digital securities exchanges. It allows issuers to quickly access the world’s capital at a fraction of the cost, providing investors with exciting investment opportunities.

For more info on James and Digital Markets please visit https://digtl.co/ten

Music courtesy of BlackIrisFilms.com

Share this article

INTRO

Hey, folks, Andy here. Welcome to Unleashed with the Dacxi Chain, the podcast that features experts from within Dacxi and from across the industry who are here to share their insights on developments shaping the global technology scene, global crowdfunding, economy, blockchain, and much more. Today’s guest is Mr. James Wallace. He’s chair of Digital Markets, which is a platform that connects the world’s best assets with global investors through a network of digital securities exchanges, allowing issuers to quickly access the world’s capital at a fraction of the cost and providing investors, of course, with those exciting investment opportunities. Welcome to the show, James.

So I’d love it if you could maybe just expand on that, tell us a little bit about who you are and your professional journey, and the lead-up to getting involved with Digital Markets.

GUEST INTRO

I’m a serial tech entrepreneur. I’ve actually been building tech for actually almost 30 years now, and it was really a result of I opening a store when I was really young. I was 16 or 17, kind of bored in high school, and decided to bounce out and go do something and opened a store selling the only thing I knew at the time, which was video games, and then quickly realized that it was a horrifying experience being the retail environment because most humans turn into savages and realized that I just couldn’t persist. There was no path forward. There was no way for me to make this work. And so sitting there and sort of my quiet desperation, having sunk everything I had into this store, this would have been the early 90s. I started thinking about researching the internet, and effectively, you probably jumped ahead with me and tried to build an e-commerce platform. Frankly, unfortunately, about ten years before it was possible. There were no merchant payment providers, and there wasn’t even inventory management software, but I ended up with a glorified digital brochure for my physical inventory. But it really taught me the power of digital, of software, of what we call now Web2 and communications. And so I pushed everything I had, all my time and energy into trying to understand what it meant. Probably about two years later, I had to make a decision, a fork in the road. Do I want to become a programmer and focus on the technical side, or do I want to basically focus on the business side? And as an entrepreneur, I knew I identified as an entrepreneur when I was really young. I decided to focus on the business side and just hire and partner with really smart technological and technical people. And so, yeah, that’s really the genesis. And over the last 25 years have mostly had failures. I’ve had a couple of successes that have led to me having a bit of capital and a bit of advice as an executive and an angel and now VC, being able to put some capital and advice into other operations, other organizations, and startups that are looking to do big things in the world. And that really brings us to Digital, where we realize that obviously, the rise of crypto showed us that there’s an insatiable appetite for retail investment. And we think it’s more than just numbers. We actually think that people want to allocate their capital to things that matter. We think that people are seeing that the government is broken, their votes don’t matter at least as much as they did. And we think a lot of people are starved of meaning. This crypto sort of wave over the last seven or eight years has really been, I think, people trying to search for things that matter, and they found projects and people and they’ve allocated capital, which is what some people that’s all the sort of domain that they have is their money. And so Digital seeing that opportunity and wanting to bring what we call market rules, which is just fairness to that sort of growing ecosystem of innovators that are looking for capital, we realize that if we brought a little bit of sensibility, we could probably find innovators capital quicker. And so we think that the world’s biggest challenges can be solved through innovation. And moving the world forward positively really is just about getting capital to these people quicker. And on the other side, the buy side, the investor side, helping them to, again, as I said, feel domain and feel like they’re shaping the future.

ANDY’S COMMENTS

Yeah, really exciting listening to your talk there, James. I can see there’s a lot of synergy between what Dacxi Chain is trying to do in the world and what you guys are doing at Digital as well. Dacxi Chain is all about building the world’s leading global crowdfunding ecosystem, but behind that, it’s all about connecting innovators with investors and empowering those innovators to bring their creative ideas to life. And of course, based on the premise, James, that innovation can come from anywhere, and while there are barriers to entry in various different markets and jurisdictions around the world, blockchain tokenization, is really beginning to enable that frictionless flow of finance and ultimately it’s just going to empower both innovators and investors all around the world. Right?

JAMES’S COMMENTS

That’s right. And what’s interesting is so early in this chat we got to something that we very rarely discuss and that is one of the core mandates of just driving capital to innovators. But as I said, it’s for that reason that we believe that a lot of the social good, the things that seem to want to become manifest and real in the world is going to be better, we think. Built and brought into the world by innovators in sort of a market scenario as opposed to maybe social programs and governments doing that work and also really addressing the reality, frankly. And again, I don’t ever try to be sensational for the purpose of being sensational but to make accurate statements. If they do sound a little bit salacious, it’s not my intention. But venture capital is predatory and investment banking is parasitic and venture capital really preys on the issuer side which beat them down. They’re the term sheets and sort of jump on the board and bully the founding team and replace the founders. And we know how that goes. So they’re extracting value from the issuer, from basically the seller of the security later in the market, and then on the buy side, we all know what the investment banks do. Ultimately, it dumps in the market after listing typically because most of the value has been extracted by them. But previous to that was the venture capital sort of a portion of that life cycle. And really a lot of founders and innovators, if you’re lucky enough to get venture capital, there’s this massive gap between your seed A, B, C, and then probably Series A-B and then the investment bank that’s going to take you public. Most people can’t cross that chasm. There’s no one there to navigate it. Why? Because it’s not profitable. And so it’s just really that sort of pitfall, that labyrinth that there’s no guidance, there’s no support. And at the same time, we’re demanding that these people go out and fix real-world problems. So they have to run a business full-time as founders, work 60, 70 hours a week, and then they have to spend 30-40 hours raising funds and managing investors and trying to navigate all of this. It really is not cleanly laid out by lawyers and accountants because frankly, they benefit from that predatory and parasitic nature. So again, obviously, we are wanting to drive capital into the innovator, but we’re also wanting them to focus on their business, to focus on solving those problems, and not spend time managing the extractors in that what we call capital markets lifecycle.

ANDY’S COMMENTS

So refreshing to hear you drop some truth bombs there, James. And I completely agree with your comments on the extractive and exploitation-based models, I suppose of both banking and VC. It really kind of reminds me of something I think you said at the beginning of the show, James. When it gets down to it, humans are savages. That’s kind of how the world works. But it’s up to us really to create models then that level the playing field, if you like, and are a bit fairer. So perhaps we can take some of that dark side of human nature out of the equation if that’s not getting too philosophical.

JAMES’S COMMENTS

Not at all. I mean, actually, philosophy in my view is very practical because when we can align around core values and principles, we can actually move really fast. I can make assumptions about other people, I know what’s important, what their priorities are and their aversions, and frankly, what they don’t want around them and we can now formulate something very quickly. So I think philosophy is good for aligning interests and should we move forward together on this project? If I understand your priorities and they match mine, the answer is probably. And to that point, you make a very interesting point. I think there is a sociopath class in my view. I see it in finance, I see it in government. We work with governments all around the world, we work in a very highly regulated space. We are discussing lobbying, and modeling frameworks that require less onerous requirements, but there’s still going to be some regulation to make sure there are market rules. And we’re exposed to a lot of people that really are void in my view of not just morals and ethics, but sort of principles and the care, let’s just say care for other people, market participants, people around them. But I think a lot of people that are not that they probably are around, that they’re in venture capital firms and hedge funds and so on are operating and behaving badly probably because they don’t know the impact. And I talk a lot about this and have for years and I think it’s not to let anyone or anything off the hook. There’s something there to make known and to bring consequences to bad behavior. But it’s only fair I think, to sort of drive it through the filter of do they know what they’re doing, do they know the pain that they’re causing? And we talk a lot about looking in the crypto world and one of the reasons that we believe that there is no doubt that we need market rules is just looking at Terra Luna’s mirror, that implosion of $60 billion. Now obviously everyone’s talking about FTX. We do see that there’s a need for market rules and all that means is just fairness. When I enter the market, can I be assured that there isn’t market manipulation? Can I be assured that there aren’t people extracting value, not providing value, etc? We think that’s fair and that could probably be algorithmic and Oracle based in the future. I think humans are very bad analyzers and distributors of consequences. I think we need algorithms to do that. But setting that aside for a second, when we look at the amount of financial damage, money damage, a lot of people at venture capital firms and hedge funds are analysts, they are in spreadsheets, they’re looking at money, they’re looking at dollars, pardon me, they’re not looking at money in dollars, they’re looking at numbers. They’re forgetting that they’re dollars and they’re forgetting more importantly, what those dollars represent. These are people’s savings. Their kids’ university, the vacation fund, all those things that frankly bring joy into our lives. And when that is destroyed, that leads to belts of anxiety, depression, and some of the big issues in society like divorce, suicide, and homicide. These are real human consequences. So getting back to the point, and again, not to be overly philosophical, it’s not at all. That is an actual, very real consequence of bad actors in the global financial system, whether that’s banking or government use of taxpayer money or capital markets. We need to remove that bad actor component, which Blockchain does, incredibly, does it with money, does it with capital markets. You can do it with voting, obviously. You can do it with a registry and sort of supply chain stuff, but we can bring transparency and remove the bad actors. And again, we’re identifying, I think, that right now and paving a way to allow that removal of those things that is going to allow us to, I think, remake the world around us.

ANDY’S COMMENTS

Yes, wonderfully said, James and I very much agree. As we’ve said, Blockchain tokenization, we’re not quite there yet, but we’re heading in that direction. It’ll make capital markets more efficient, and more transparent, and that is really what Blockchain exists to do. Bitcoin was created to take trust out of the equation because I think, as we’ve kind of alluded to James, yeah, it’s difficult to trust humans that you don’t know. And well, blockchain exists to solve that problem. And just while we’re talking about those bad actors, refreshing to see that Sam Bankman Fried was arrested around 12 hours ago and does look like he is now going to face the full consequences of his actions, as he should.

JAMES’S COMMENTS

I was surprised it took them that long to do that, especially with all the fact that he testified in front of Congress and the political donations and so on. His involvement really in legacy and in governance is probably going to adversely affect him. And when we look and compare with a lot of other bad actors in crypto, how they still walk free as well, I think about Do Kwon and others actually. Really, actually to step back and connect what you just said just now and previous, and what I was saying is that excluding that sociopath class that really intends to extract, I think a lot of people are behaving slightly badly because they don’t know what they’re doing. And that idea of Blockchain, that pseudonymous transparency sort of, I think drives this nice sweet spot between privacy and activates awareness that when this happens, these other things happen and we don’t hide them behind this. If you look at capital markets, you have transfer agents and custodians and market makers, and then you have the exchange and you have all these various components that actually act to sort of remove people A from understanding and B from feeling any responsibility. Hey, I’m just doing that little thing over here. I extract that bit of money. I wasn’t really responsible for all this. Thinking about legacy HSBC banking, the Mexican cartel, and Lehman Brothers, the fraud that occurred there. Everyone can sort of has that plausible deniability of, oh, there’s a separation of concerns. I wasn’t the start and the end. I played a minor role and I did my job. Whereas I think, again, with blockchain we’re driving toward, there is incredibly this element of transparency that allows us, and again, when we drive and you talk about crowdfunding, that’s about disintermediating a pile of players, which is fantastic. And again, if it’s truly peer to peer and we talk in our world, because our world, which is full stock exchange listings, fully public, no restrictions on trading, we don’t see probably in the next five to ten years that there’s going to be a peer to peer possibility for at least global retail cross-jurisdictional trading. But we do see something close to it and we’re calling it near-peer. But the whole idea, again, is to drive the two people that create the value, the innovator and the capital contributor, to as close to direct as possible and remove all the other market participants that just frankly extract and distort, and to make sure that we have the cleanest transfer of value in both directions. And then we have this tiny layer of regulation just to make sure that the issuer and the seller of securities is a real person with a viable ongoing concern and is managing their operation responsibly. And again, on the buyer side, that this is a real person that’s not a terrorist or money-launderer, and then they should be able to transact. But again, to your point, I think that, or your last comment, I should say it is really good to see SBF brought in. I think there are a bunch of assumptions in all directions that are somewhere between wrong and right and probably a lot of stuff in the middle. And I think it’s just important for the entire world because now we’re driving crowdfunding platforms, crypto, and other sorts of direct participation. We have a lot of people in the world that can now directly participate in finance. And this is I think, we’ve underestimated the value of increasing people’s financial intelligence. Your attention goes where your money flows. If you put money into something, you’re going to start paying attention. People know so much about finance. They have a long way to go because we, I think, have been intentionally miseducated and non-educated on finance, so that we become sort of the liquidity, we become the spenders and the consumers and not sort of the capitalists. But I think there’s been a massive transformation. People are becoming educated and we’re very close with the Wall Street Bets team, the founders, and 17 million people that are calling out bad behavior. They’re informing themselves. They’re in dialogue all day long. Discussing different aspects of finance and so, yeah. We should have lots of conversations, he should provide all the evidence. And then a judge or a jury needs to determine if there’s criminal activity. But the entire world and those participants, especially direct FTX, deserve to know exactly what happened. And we as a community, a global community of probably tens of millions of retail investors, need to be able to harvest that learning and make sure that we don’t do it again.

ANDY’S COMMENTS

Absolutely. Thank you. James, so many threads I could pick up on there. I did love the quote. I don’t know if this is from you or something you’ve picked up along the way. I think you said something like, your attention goes where your money flows. I enjoyed that. You did explain it a little bit in there as well. But I think it’d be good just to give you the opportunity again, just to talk through how Digital works. Maybe explain a bit more, James, in terms of who the platform is really aimed at and who can access it, what the opportunities are, I suppose both on the innovator’s side, if you like, and of course, on the investor side.

JAMES’S COMMENTS

It took us about five years to build this. In the first three years, we focused strictly on compliance because we realized that if we didn’t have a platform that was safe and secure and not technologically from a regulatory and compliance standpoint, then ourselves, maybe especially because that’s very risky, as SBF is finding out, not operating a platform, it’s beyond compliance. But one of our predecessors, Exponential Ventures, was the Solicit investor in the world’s first federally approved digital security out of Bermuda in 2018. And that platform is fantastic. The Premier, Bert, the BMA, the Bermuda Monetary Authority, and the Ministry of Finance, they all want this equal access to digital assets, but also equity. Again, people, I think have the right to direct their money. And this notion of not of accredited, only getting access to frankly the most lucrative under the veil of investor protections we know is itself a fraud, in my view. I think that the intentions are good. Most people at regulators are good people and really, truly want to protect the investor. But what it’s created is, again, if I’m being somewhat sensational, effectively, what we have is a bunch of rich old white dudes as chairs at these venture capital funds that are directing tens of billions of dollars towards things that, if we’re just being not even honest about but objective about. There’s a worldview of this type of person and it doesn’t represent the world. And so these people are shaping the world as they see the world, and we need more people to participate in shaping the world. I’d rather have 3 billion people shape the world than 300 people. Bermuda opened up its platform and said, come on in and let’s talk let’s figure it out. It had never been done before. It took us a lot longer and it cost us a lot more than we thought, but it was very valuable and it led us to about three years of just talking to other regulators, talking to a lot of lawyers, Canada, the US, UK. BBI, Seychelles, etc, Bermuda, and knitting together a cross-jurisdictional securities trading framework. And our outrageous demand was that it must be retail, meaning every single person in the world, nonaccredited, other than OECD Band, which would be, say, Venezuela and Iran, must be able to access the platform with no restrictions and trade their securities. And everyone said it couldn’t be done, you shouldn’t try it, you’re going to kill yourself, it’s going to be awful, you’re going to hate everything and everyone. And there were times when we did, but the bottom line is where we ended up was that we now have via Commercial Partners, which is a network of digital securities exchanges, as you said in the intro, and they have stock exchange licenses and clearing and settlement facilities and registries. And maybe that doesn’t mean much to a lot of the listeners, but these are essential components to capital markets and without them, you must rely on a third party. And a lot of third parties that are not blockchain-based claim that they don’t understand the technology and claim that there’s a risk, but it’s actually most often anti-competition. They know that blockchain in many cases disintermediates them, not a little bit, but entirely and permanently. And so they’ve held out. We’ve been able to, through our capital markets exchange partners, put together an end capital market system. They can’t be interrupted, which is essential. And then we’ve laid on a few registrations like we have a transfer agent in the US. Money services business in Canada, a trusted company in Europe, and effectively what that’s allowed us to do, it’s a very long way for those that are interested in actually how it works, which is the hard part and the painful part that’s allowed us to get to the point today where we can list on a national stock exchange with the ability to clear and settle and register on a blockchain. We can list any asset type, fund, debt, equity, or whatever, from any issuer located anywhere in the world. So that’s the sell side. And then on the buy side, we can make that available to any investor type, credited or not, located anywhere in the world, including the US. And so we’ve been able to stitch together an entire marketplace that has no restrictions. Now, there’s a lot of work still that goes into the investment bankers putting together prospectuses, and often we have to bring in introducing brokers and they’re still market participants. But it’s getting us through this part right now and we continue to look at ways to bring in retail and issuers from all over the world without unnecessary intermediaries.

ANDY’S COMMENTS

Very nice. Thank you, James. And, of course, listeners, if you’re intrigued by the sound of Digital and what James is describing there, do suggest that you check out the website, which is Digtl.co. But Digital, of course, is spelled D-I-G-T-L in this case. But of course, a link will be in the show notes as well. As we start to wrap up James, maybe it’d be good. I just love to get your kind of perspectives, if you feel free to kind of speculate away, but just kind of cast your forecasting mind forward. Approach this any way you like. Maybe just to describe the world 5-10 years from now, if we talk again about this idea that you mentioned, your attention goes where your money flows. And how investors can begin to impact the world, how they can shape the world with their money even more than, say, their votes. And what change can we really make around the world as this sort of global, equity-based, equality-based, crowdfunding ecosystem enables all these new opportunities? Again, just any way you want to approach that, please go for gold.

JAMES’S COMMENTS

Well, you said it so well there, I hardly want to add anything to it. I mean, I think you really described that as a grassroots, community-based network of people that are talking about what’s important in life, in contrast, frankly, probably around what’s wrong in our society. A lot of the time when we bring in extraordinary innovations and we shift positively, it’s in reaction to something very negative in our world. And so even on our platform, if we look at it today, and I don’t know if this is doable or reasonable, but if there’s a way to provide a gift card link, we’ll do that. So maybe you and I can talk via email after. But I would love to invite people to the platform, not to self-promote, but really to make it available. And we can provide some USDC to play like real USDC to play with the site and look around because we have things like block streams, and mining. We have a bunch of Wall Street bets products, an insider portfolio, and El Sal, which is a basket of El Salvador funds bonds, you can’t easily get access to. And that’s just a really like, these are really good examples of, I think, products that people want from brands that people trust. And that feels good when you engage a brand that you trust. Again, going back to philosophy, hey, our core values are the same. Let’s go. I don’t need to sit here and verify and argue and debate. I already know what you stand for. I already know what you want. I think the shorthand and the short form, frankly, in crypto and specifically with Bitcoin and Blockchain, I think is spectacular. Being able to lurch forward and launch forward three years and not have to try to get the basics set. I think that the framework is built on is meant to be community driven. And I think a lot of the governance tokens were scams, frankly, and the consolidation of power. ICO 2.0 really was that innovation there was to try to bring the community and kind of like Web 2.0, right? Which that innovation from static websites now people and participants communicating with each other. I think we got that in Crypto 2.0, and ICO 2.0. But again, it was to benefit a few people, just like it benefited a few people. Web 2.0 benefited a few participants. I think that the future is truly about community-driven projects, and I’m not just talking about a couple. We talk a lot about it. There are 50 IPOs in the US, every year. There should be 500 minimum. There are 2200 in Canada. It’s because we have a different sort of approach to it. We want to see more innovation. We make markets for e-gaming and crypto and cannabis, and now we’re doing it for psychedelics. Why not let’s drive capital into these innovators? So that’s the micro IPO, they call it up here. Why not have a nano IPO?I don’t know why we can’t have like a kiva for capital markets. Why, if we bring down the cost and we just lightly wrap it, make sure there are investor protections, things are going to go bankrupt, founders are going to die, things will go badly, but it’ll be a small portion, no more than necessary. And what would kind of naturally happen in life? And if we just have people that are able to sit on a platform and talk about what’s important, find people that want and need capital, that are committed to that solution and productizing it and driving it into the market, in my view. So answering the question of 5-10 years, the people that are truly activated intellectually, emotionally, mentally, even energetically, are the ones that have actually connected to meaning, are the ones that are working every day. I use that word, interestingly, working, come home from work, and then I jump on this platform and it could be Digital or it could be something similar. We don’t have any thoughts of competition or exclusion. We want everyone to come in. But I think it is people that are working on things that matter, exclusive of family, society, politicians, governance, religion, school, whatever. These are individuals that are finding like-minded individuals and collaborating on things. And part of that is not just capital, but it’s applying knowledge and connections and so on. So, yeah, I think that that’s the future. I think that we’re going to see things revert. We’ve had a top-down system, frankly, for millennia, and I think probably the intelligence of the lower class and middle class and the technology just wasn’t there. And now we have a very educated lower middle class and we have networking technology that can bring us together. And I think we’ve, frankly, really screwed up Web 2.0. We have a lot of disinformation and misinformation, and a lot of division as a result. But I’m hopeful, and I think this is rooted in reality, I’m hopeful that we learn those lessons and we’re able to move into what they call Web3. I don’t mean that in the crypto sense, but I do mean that in a decentralized network that is actually being operated on behalf of the people, instead of in Web 2.0, being operated collectively on behalf of a handful of people.

ANDY’S COMMENTS

Again. Very nicely said, James. Thank you so much for that. Nothing else to say, really, except, I suppose please, James, tell the listeners where you can be found online if you like to hang out on Twitter or perhaps you’re a LinkedIn person. Some people do both even. What a crazy old world. And again, just tell people where they can go to learn more about what you guys are building at Digital.

JAMES’S COMMENTS

That’s funny, I’ve been too busy building things to mess around with LinkedIn or Twitter. I have profiles there, but I rarely use them. I’d encourage a lot more people, especially crypto Twitter. Stop tweeting, stop being an antagonist, and go build stuff, please. The world needs you to do things and not talk. But as I said, I’m hopeful that we can provide a link in the description that can help people get to where I think I’m available and I’m happy to make myself available with a personal link in the description. But I think joining the community is the key. That’s what I would want everyone to do. We are building right now through a framework that we’re re-architecting after some of these exchange tokens have failed and governance tokens have failed. But we really want to be able to measure and allow people to apply their views. We want them to literally vote on these things. And so anyway, the people will be able to come to the platform and tell us what they want and we will list it on a national stock exchange and you’ll be able to provide capital to activate getting connected. And yeah, we’ll make those links available in the description. We’re here to serve.

ANDY’S FINAL COMMENTS

That was James from Digital. Man, I really enjoyed that James. He was great. Great guest, an excellent talker, very opinionated, and very smart, really enjoyed talking to James. So James has kindly provided us with a link that will be or is in the show notes, which will get you access to have a little look around Digital. Please feel free to check that out. Also thought it was interesting to hear what James and the team are doing at Digital. And as I said in the show, I think the very clear synergies between what platforms like Digital are doing and what platforms like the Dacxi Chain doing. Everyone is really focused on unlocking this global tidal wave of innovation that becomes possible when you connect everyday global investors all around the world with everyday global innovators all around the world and just unleash the power of new, creative, innovative ideas. And that can only be a net good for the planet. Really exciting to see how all this plays out over the years to come. And don’t forget, of course, we’ll be tracking it all the way. We’ll be talking to all the movers and shakers leading this movement all around the world right here on Unleashed with the Dacxi Chain, the podcast that you’re listening to. So please make sure, listeners, that you subscribe to the podcast in whatever podcast app you are using. Give us a five-star rating and give us a review. We’d really appreciate it as a new podcast, but mostly we just appreciate you listening. Thanks again, team.

This was Unleashed with the Dacxi Chain. See you next time. Bye for now.

The Future of Equity Crowdfunding — As the Experts See It in 2022

On a recent episode of Dacxi Chain’s podcast “Unleashed“, Andy Pickering sat down with Dacxi CEO Ian Lowe. Ian tells Andy about his time at the 2022 Equity Crowdfunding Conference in Los Angeles and what he discovered. They covered everything from what equity crowdfunding will mean for Venture Capital (VC) to funding space travel. Let’s look at what Ian found at the conference and how Dacxi fits into all of it.

The 2022 Equity Crowdfunding Conference — What Is It?

The 2022 Equity Crowdfunding Conference in Los Angeles was held by leading crowdfunding platform providers and VCs, providing a “melting pot” of experiences and insights. A variety of panel sessions discussed the future of equity crowdfunding and how it will impact VC and the investment market as a whole. It was also an excellent opportunity for early-stage businesses to present their ideas and receive expert feedback.

What Were the Main Takeaways From the Equity Crowdfunding Conference?

Investing in Private Company Will Be as Easy as Investing in a Public Company

Ian revealed that in a panel session of leading crowdfunding CEOs, it was agreed that five years from now, investing in a private company should be as easy to do as investing in a public company. This would mean that the friction and time-consuming investment process would be gone, making it far more convenient for retail investors to participate in the private equity sector.

Ian elaborated, “Crowdfunding technology, the feature sets, all the things that that are in and around that experience for the retail investor, are going to continue to improve and be refined — and the technology will improve to the point where it’s going to be just as easy for that retail investor to participate in the private company investment opportunity as it is in the public company sector”.

Tokenization Will Be the Standard for Private Investment

The same panel of CEOs also agreed that the tokenization revolution would transform investing in private companies into a universal standard across all retail investors. This is largely due to tokenization being made available as a blockchain innovation, allowing for a more secure transfer of ownership. This technology also makes storing and trading these assets easier, ultimately providing investors with a better experience.

Ian further shared his insight from the panel: “In terms of the language of this, many would call it investing in private companies. In truth, it’s actually investing in the innovation economy. This is the structural change that crowdfunding (is offering) as it’s now gathering real momentum. And clearly, this is across the world, the structural change that it’s bringing to capital markets”.

It’s this sort of fundamental change in the paradigm of investing and capital markets that equity crowdfunding is bringing about, and it’s set to be a literal game-changer for retail investors across the globe.

Equity Crowdfunding Will Be Global

The panel at the conference agreed that equity crowdfunding will be a global phenomenon within five years. It’s believed this new form of investing will move away from its regional roots and become a truly global movement in a relatively short period of time. This means that investors worldwide will soon have access to international investment opportunities that they would otherwise not have had access to.

Ian explained, “Now it’s very clear, you know, from the largest companies in the industry, and the leaders of those companies that that that is absolutely the direction of travel. And so, you know, that’s obviously enormously exciting”.

Ian added that it wasn’t just the global scope of equity crowdfunding but the extent of innovation it will foster: “What struck me is… the breadth of innovation available… there’s everything from the future of healthcare, fire and smoke, the future of cannabis, to the moon, investing in space, clean tech solutions for the future… and it just goes on and on. I get really excited by all this kind of talk of the future and how human innovation and imagination can take us”.

There Will Still Be Room for VC