Building the Rails for Global Crowdfunding: Dacxi Chain's 2025 Infrastructure Milestone

How the world’s first cross-border equity crowdfunding deal signals a fundamental shift from platform competition to collaborative infrastructure

The equity crowdfunding industry stands at an inflection point. While platforms have focused on competing for market share within their jurisdictions, a more fundamental challenge has emerged: the need for infrastructure that enables global capital flow without sacrificing regulatory compliance or platform autonomy.

This infrastructure-first approach isn’t new to blockchain ecosystems. Just as Polkadot built interoperability rails for the multi-chain future, and Solana architected high-throughput infrastructure for DeFi applications, the equity crowdfunding sector requires foundational technology that enables collaboration rather than competition.

That’s precisely what Dacxi Chain has been building – and 2025 has proven to be our breakthrough year.

The Infrastructure Imperative

The global equity crowdfunding market, valued at approximately $2.1 billion in 2025 with projections exceeding $5 billion by 2032, faces a structural challenge that growth alone cannot solve. Despite regulatory harmonization efforts like the EU’s ECSPR framework, platforms remain largely isolated, creating inefficiencies that limit both capital access and investor opportunity.

Consider the numbers: research indicates that 50% of crowdfunding campaigns raise minimal amounts, while only 10% achieve significant success. This isn’t primarily due to poor ideas or insufficient capital – it’s a distribution and matching problem. The right investors exist, but fragmented infrastructure prevents efficient discovery and cross-border participation.

The solution requires infrastructure thinking, not platform thinking.

Proving the Concept: World’s First Cross-Border Success

In the first half of 2025, Dacxi Chain completed the world’s first cross-jurisdiction equity crowdfunding deal, connecting UK-based Angels Den with Latvia’s Crowded Hero. This wasn’t merely a technical achievement – it was validation of a fundamentally different approach to global crowdfunding infrastructure.

The breakthrough demonstrated several critical capabilities:

Regulatory Harmony Without Homogenization: Each platform maintained its regulatory compliance framework while enabling seamless cross-border investor participation. This preserves jurisdictional sovereignty while creating global connectivity- a balance that traditional financial infrastructure has struggled to achieve.

Trust Layer Scalability: By implementing blockchain-secured attribution and transparent due diligence standards, we created portable trust that transcends geographic boundaries. Investors could participate confidently in foreign deals without duplicating compliance processes.

Economic Alignment: Smart contract-based revenue sharing ensured that referring platforms earned from cross-border activity, creating sustainable incentives for collaboration rather than competition.

Technical Foundation: Platform 1.0 and Blockchain Infrastructure

While the cross-border deal captured headlines, the underlying technical achievements represent the more significant long-term value creation:

Platform 1.0 Deployment: Our core infrastructure now supports live partner integrations, providing the API framework that enables platform collaboration without platform consolidation. Unlike traditional marketplace models that seek to centralize activity, our infrastructure empowers distributed networks.

Blockchain Architecture: The deployment of our proprietary blockchain infrastructure creates the foundation for immutable transaction records, automated compliance verification, and tokenized equity management – capabilities that will prove essential as the industry evolves toward programmable securities.

Leadership Expansion: The addition of our Chief Product Officer reflects our commitment to scaling technical excellence while maintaining the product focus necessary for complex B2B infrastructure.

Enhanced Token Economics: The operational launch of our enhanced Dacxi Coin [DXI] framework demonstrates practical utility in network economics, moving beyond speculative token models toward genuine economic infrastructure.

Strategic Positioning: GECA Partnership and Industry Leadership

Our strategic partnership with the Global Equity Crowdfunding Association (GECA) positions Dacxi Chain at the center of industry evolution rather than on its periphery. This isn’t simply business development – it’s recognition that infrastructure providers must actively shape regulatory and industry standards rather than merely respond to them.

This approach mirrors successful infrastructure projects across the blockchain ecosystem, where technical excellence combines with active governance participation to drive adoption and standard-setting.

The Road Ahead: Platform 2.0 and Global Expansion

The second half of 2025 will see significant infrastructure expansion that builds upon our validated foundation:

Advanced Tokenization (Platform 2.0): Our upcoming platform will introduce programmable equity capabilities, enabling automated compliance, fractional ownership, and enhanced liquidity options. This represents a fundamental evolution from static equity instruments toward dynamic, blockchain-native securities.

US Market Integration: Extending our infrastructure to support Regulation CF compliance opens access to the world’s largest equity crowdfunding market while maintaining our core principle of local regulatory responsibility with global connectivity.

Accelerated Partnership Growth: With proven technology and validated business models, we anticipate significant acceleration in platform integration and transaction volume throughout the remainder of 2025.

Exchange Infrastructure: Our pursuit of Tier 1 exchange listing for DXI reflects the maturation of our token economics from network utility toward broader market recognition and liquidity.

Industry Implications: From Competition to Collaboration

The success of our cross-border infrastructure suggests a broader shift in how financial technology evolves. Rather than winner-take-all platform dynamics, we’re seeing the emergence of collaborative infrastructure that enables multiple participants to thrive.

This mirrors broader trends in blockchain and fintech, where infrastructure providers like Stripe in payments, Plaid in banking connectivity, and Chainlink in blockchain oracles have created more value by enabling ecosystems rather than competing within them.

For equity crowdfunding, this means:

- Platforms can focus on their core competencies (regulatory compliance, investor relations, local market expertise) while leveraging shared infrastructure for global reach

- Investors gain access to diversified opportunities without navigating multiple compliance frameworks

- Entrepreneurs can access global capital while working through familiar, trusted local platforms

- Regulators can maintain oversight within their jurisdictions while enabling cross-border capital flow

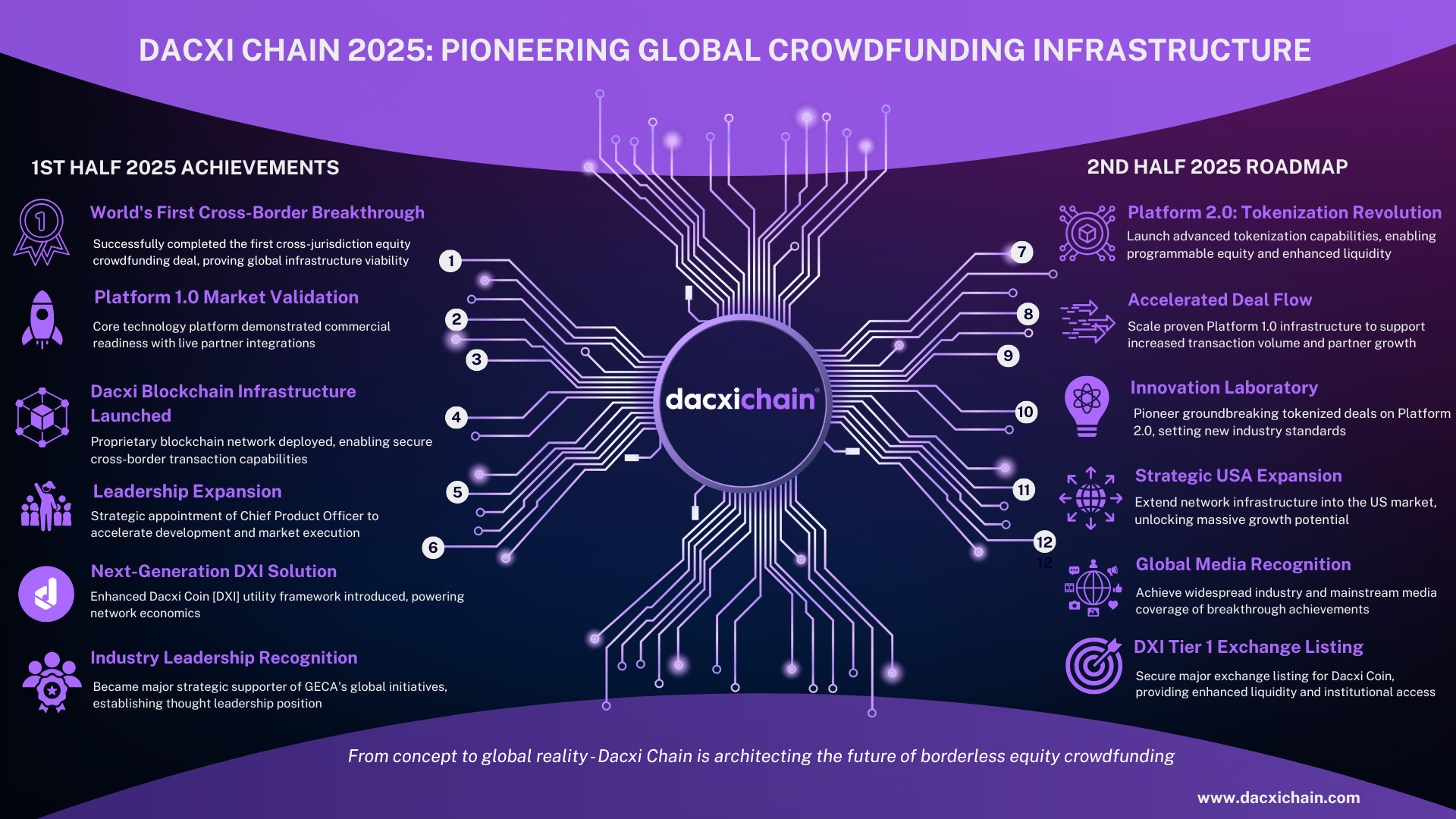

The Complete Picture: Download Our 2025 Progress Report

To provide stakeholders with comprehensive insight into our achievements and roadmap, we’ve created a detailed infographic that captures our complete 2025 journey – from breakthrough milestones to future developments.

[Download the full Dacxi Chain 2025 Progress Infographic here]

This resource provides visual representation of our technical achievements, partnership growth, regulatory progress, and strategic roadmap through 2026.

Looking Forward: Infrastructure for the Next Decade

The equity crowdfunding industry is transitioning from early-stage experimentation toward mature infrastructure. Just as the internet required fundamental protocols before applications could flourish, global crowdfunding requires collaborative infrastructure before its full potential can be realized.

Dacxi Chain’s 2025 achievements – from cross-border breakthrough to blockchain deployment—represent foundational infrastructure that enables rather than constrains innovation. As we expand into the US market and launch advanced tokenization capabilities, we’re not just growing our own platform; we’re building the rails upon which the next generation of global crowdfunding will operate.

The momentum is building, and the infrastructure is ready. What remains is scaling the collaborative framework that enables platforms worldwide to participate in truly global capital markets while maintaining their independence, compliance, and competitive differentiation.

For platforms, investors, and industry participants, 2025 marks the beginning of infrastructure-enabled global crowdfunding. The question isn’t whether this future will arrive – it’s whether stakeholders will actively participate in building it.

Interested in exploring partnership opportunities or learning more about our expanding infrastructure? Connect with our team at [email protected] or visit dacxichain.com.

For comprehensive details on our 2025 progress and future roadmap, download our complete infographic using the link above.

How Crowdfunding for Innovation Can Boost Local Economies: The Future of Community-Backed Investment

Discover how equity crowdfunding is transforming local economies worldwide and why decentralized infrastructure is the key to unlocking global capital for community innovation.

Introduction: The Capital Gap That’s Stifling Local Innovation

Small businesses create two-thirds of new jobs and serve as the lifeblood of local economies, yet they face a persistent challenge: accessing growth capital outside major financial hubs. While venture capital flows concentrate in established centers like Silicon Valley and London, countless innovative entrepreneurs in smaller cities and developing regions struggle to secure the funding they need to scale their ideas.

Enter equity crowdfunding- a revolutionary model that’s flipping conventional finance on its head. Instead of relying solely on banks or institutional investors, this approach taps into the “crowd” – communities of customers, neighbors, and supporters who become stakeholders in local innovation.

This isn’t just a funding trend; it’s a global movement with profound local impact. The World Bank projected crowdfunding could reach $96 billion by 2025, potentially outpacing venture capital in developing countries. Today’s global equity crowdfunding market, valued at approximately $2.1 billion in 2025, is projected to exceed $5 billion by 2032, growing at 13-15% annually.

But here’s the remarkable part: this growth represents more than numbers – it signals a fundamental shift toward inclusive, community-driven economic development that keeps wealth circulating locally while fostering innovation globally.

The Global Rise of Equity Crowdfunding: From Novelty to Economic Necessity

Legislative Milestones That Changed Everything

The transformation began with landmark legislation. The U.S. JOBS Act of 2012 and subsequent Regulation Crowdfunding in 2016 opened startup investing to non-accredited investors, democratizing access to early-stage opportunities. The results were dramatic: U.S. equity crowdfunding exploded from just $19 million in 2016 to $479 million in 2021 – a 25-fold increase that reflects surging investor appetite.

The United Kingdom pioneered early adoption, with firms raising £335 million via crowdfunding in 2024 alone. But perhaps the most significant development came from the European Union, which implemented harmonized Crowdfunding Regulation (ECSP) in 2021, allowing platforms to operate across all 27 member states under a unified framework.

A Truly Global Phenomenon

Today’s crowdfunding landscape spans continents:

Europe: The EU’s unified approach enables cross-border raises up to €5 million, with 17% of investments now occurring across borders – a figure poised for rapid growth.

North America: Both the U.S. (with its $5M Reg CF cap) and Canada have demonstrated steady growth, validating crowdfunding’s role in mainstream finance.

Asia-Pacific & Emerging Markets: Countries from Malaysia to New Zealand have crafted their own frameworks, often inspired by global best practices. Malaysia integrated crowdfunding into SME financing strategy, while Kenya’s Climate Innovation Center piloted community capital models.

Beyond Tech Startups: A Broader Innovation Ecosystem

The impact extends far beyond Silicon Valley-style startups. Local breweries, social enterprises, clean energy projects, and community services have all leveraged crowdfunding to innovate and expand. BrewDog’s “Equity for Punks” campaign in Scotland famously turned customers into shareholders, while countless local businesses have used community investment to weather challenges like COVID-19.

International development organizations increasingly view crowdfunding as essential infrastructure for inclusive economic development – validation that sets the stage for addressing remaining barriers to its full potential.

The Four Structural Challenges Limiting Crowdfunding’s Impact

Despite remarkable growth, structural barriers still constrain crowdfunding’s ability to drive local innovation at scale.

1. Geographic Capital Concentration

The Funding Desert Problem: Venture capital and traditional financing cluster in major metropolitan areas, leaving vast regions capital-starved. A handful of U.S. metro areas receive the majority of VC funding, while globally, there’s an MSME finance gap exceeding $5 trillion.

Early-Stage and Minority Entrepreneurs: The challenge intensifies for very early-stage startups and underrepresented founders. Traditional lenders demand collateral and proven revenues, while VCs often rely on networks that overlook outsiders, forcing many entrepreneurs to resort to credit cards or personal debt.

2. Trust and Information Asymmetries

The Confidence Gap: Retail investors face legitimate concerns about fraud, mismanagement, and startup failure rates. Unlike public markets, private ventures often lack transparency, and high-profile failures have made some investors cautious.

Distance Breeds Doubt: When investors are geographically or socially distant from entrepreneurs, information gaps amplify mistrust. Cross-border investments face additional hurdles as investors struggle to assess foreign market conditions or founder credibility.

3. Regulatory Fragmentation

A Patchwork of Rules: Every jurisdiction maintains different crowdfunding regulations – varying caps, investor eligibility, and compliance requirements. This fragmentation historically prevented cross-border deal flow, confining entrepreneurs to their home markets regardless of foreign investor interest.

Compliance Complexity: The maze of regulations deters platform expansion and limits investor participation. Legal uncertainty and compliance costs can make cross-border operations prohibitively complex.

4. Platform Isolation and Scale Limitations

Islands of Opportunity: The crowdfunding ecosystem consists of hundreds of independent platforms – isolated “islands” with separate investor pools and deal listings. A promising clean-tech startup in Peru might never reach a eager investor in Canada, and vice versa.

Duplicated Inefficiencies: Fragmentation forces each platform to develop its own technology, due diligence processes, and investor acquisition strategies. This duplication creates inconsistent quality and limits smaller platforms’ ability to achieve liquidity or fund large deals.

Community-Backed Investment: The Foundation of Inclusive Growth

Aligning Investors with Community Success

Community-backed crowdfunding creates powerful alignment between investors and local prosperity. Unlike distant banks or VCs, the “crowd” often consists of customers, neighbors, and community members who are literally invested in local growth. This creates a virtuous cycle: investors become loyal customers and advocates, businesses gain market validation, and economic benefits circulate locally.

Democratizing Wealth Creation

Crowdfunding lowers barriers so anyone (within regulatory limits) can become an investor, not just the wealthy elite. This democratization benefits both sides:

For Entrepreneurs: Research shows female entrepreneurs outperform men by 17% in equity crowdfunding success rates, while minority founders leverage online platforms to reach supportive communities when traditional funding sources shut them out. The democratic nature of crowdfunding can bypass systemic biases present in conventional finance.

For Investors: Local residents can now participate in wealth creation by owning stakes in businesses they frequent or believe in – an opportunity previously reserved for accredited investors. Even small investments allow individuals to have skin in the game of local progress.

The Loyalty Effect in Action

The feedback loop created by community investment is remarkable. When locals fund a project, they become more than investors – they become stakeholders in its success. They patronize the business, promote it to friends, and often provide valuable advice. This loyalty effect boosts performance and creates resilience, as demonstrated during COVID-19 when communities rallied to save beloved local businesses through investment crowdfunding.

Measurable Economic Impact

The broader economic benefits are clear: community-backed crowdfunding fosters inclusive growth where innovation benefits don’t just accrue to distant investors but are shared with the community. It keeps wealth circulating locally, builds grassroots support for entrepreneurs, and jump-starts economic diversification in areas that need it most.

Decentralized Infrastructure: The Key to Global Scale

Technology as the Great Connector

The solution to crowdfunding’s structural challenges lies in decentralized infrastructure that connects isolated platforms into an interoperable network – much like how the internet connected isolated networks into a global system.

Cross-Border Deal Syndication

Forward-thinking platforms are already forming partnerships through reciprocal listing agreements and shared deal syndication. This collaboration allows entrepreneurs to access global capital while each platform maintains local compliance. Europe’s regulatory harmonization has enabled 17% of investments to flow cross-border – a figure expected to grow dramatically with better infrastructure.

Standardized Trust at Scale

Shared standards and due diligence protocols can build trust across networks. Platforms adopting standardized disclosure forms and pooling resources for vetting deals create consistency that enables cross-border confidence. Blockchain technology further enhances trust by providing transparent, immutable records of investments and company performance.

Automated Compliance

Smart contracts and programmable compliance can handle differing regulations automatically. A blockchain-based system could enforce investor limits and eligibility requirements by jurisdiction through code, ensuring each cross-border investment abides by local laws while removing friction from the process.

The Liquidity Frontier

Tokenizing equity – converting shares into digital tokens – could unlock secondary markets for crowdfunded securities. While still emerging, this innovation could address the liquidity challenge that has historically limited crowdfunding’s appeal to investors seeking flexibility.

Case Study: Dacxi Chain – Pioneering Global Crowdfunding Infrastructure

Connecting Local Platforms to Global Capital

Dacxi Chain represents the first comprehensive attempt to build the infrastructure crowdfunding needs to reach its full potential. As the world’s first global equity crowdfunding ecosystem, it’s a blockchain-powered network that connects numerous platforms into a unified global marketplace while maintaining local autonomy and compliance.

How the Model Works

Global Deal Sharing: Dacxi Chain’s platform-agnostic infrastructure enables licensed crowdfunding platforms to share deals and investors internationally. An entrepreneur listing on one connected platform can gain global reach, attracting capital from investors on other platforms worldwide.

Maintaining Compliance: The system acts as a secure cross-border referral network, handling all legal requirements when investors from one country fund deals in another. Blockchain’s immutable records provide audit trails while each platform maintains its independence and client relationships.

Collaborative Growth: Rather than displacing local platforms, Dacxi Chain empowers them. Platforms remain autonomous yet leverage shared deal-flow and global investor liquidity to boost their success – addressing the scale problem that has limited smaller markets.

Real-World Validation

In late 2024, Dacxi Chain facilitated the first cross-border equity crowdfunding deal between UK-based Angels Den and Latvia’s Crowded Hero. This pilot saw a UK startup successfully attract investors from multiple European countries, proving the concept works in practice.

Platform executives were enthusiastic about the results. Angels Den’s CEO noted that “Dacxi Chain’s technology allows us to extend opportunities beyond the UK, giving our entrepreneurs international exposure while maintaining all necessary regulatory controls.” Crowded Hero’s CEO added that the collaboration “addresses one of crowdfunding’s fundamental challenges” and demonstrated that “international investment flow is not just possible but practical.”

Scaling the Vision

Following this success, Dacxi Chain is onboarding additional platforms across Europe and initiating discussions in the U.S. market, moving toward a truly interconnected global ecosystem. This case illustrates how decentralized infrastructure can boost local economies: startups in smaller markets can secure funding unavailable locally, while investors everywhere can back ideas that create jobs and innovation in communities worldwide.

The Future of Crowdfunding: Borderless, Collaborative, and Community-Driven

The Path Forward

To fully realize crowdfunding’s potential for local economic development, continued collaboration is essential:

Policymakers should craft enabling yet protective regulations, learning from successful frameworks worldwide while maintaining investor protection.

Platforms should embrace collaboration and shared infrastructure to overcome fragmentation and achieve the scale necessary for global impact.

Communities should integrate crowdfunding into their economic development toolkit, recognizing its power to channel investment into underserved areas and nascent innovations.

A Vision of Inclusive Innovation

When executed properly, crowdfunding channels investment into underserved areas and emerging innovations, fostering truly inclusive growth. It’s a model where the benefits of innovation – new businesses, jobs, and financial returns – are shared broadly rather than captured by a select few.

The convergence of community-driven finance and decentralized infrastructure signals that the next decade could witness the emergence of a truly global crowdfunding network – one that levels the playing field for innovators everywhere while strengthening local economies worldwide.

The Momentum is Building

As demonstrated by Dacxi Chain’s breakthrough and the rapid global adoption of crowdfunding regulations, the infrastructure for borderless, collaborative crowdfunding is becoming reality. When a great idea in a small town can attract support from across the world, and when everyday people can back the innovations they believe in, local economies everywhere stand to benefit.

The future of crowdfunding is borderless, collaborative, and rich with opportunity to boost local prosperity through innovation. The momentum is building – now it’s about scaling these breakthroughs so that crowdfunding can become a cornerstone of economic development worldwide.

Ready to explore how your platform can tap into the global crowdfunding network? Learn more about joining the collaborative infrastructure that’s connecting local innovation to global capital.

Email Andrew Field – Head of Partnerships: [email protected]

Dacxi Chain Successfully Pilots First Cross-Border Equity Crowdfunding Deal Sharing

Dacxi Chain Technology Creates New Pathway for Global Investment

09/04/25 – London, UK – Dacxi Chain has successfully completed the first cross-border equity crowdfunding pilot deal sharing, marking a significant milestone in the evolution of the crowdfunding industry. This achievement demonstrates how technology can overcome geographical limitations, creating a more connected global investment ecosystem.

The pioneering pilot connected UK-based Angels Den with Latvia's Crowded Hero, proving the viability of international collaboration between licensed crowdfunding platforms. This breakthrough allows entrepreneurs to access broader funding sources while giving investors exposure to opportunities beyond their local markets.

Transforming Crowdfunding Through Global Connectivity

The crowdfunding sector has historically been constrained by geographical and regulatory boundaries. Dacxi Chain's technology creates a pathway for platforms to operate beyond these limitations while maintaining regulatory compliance.

This pilot demonstrates several key advantages:

- Global Reach for Growth Companies – Entrepreneurs can now attract capital from international investors.

- Diversified Investment Opportunities – Investors gain access to promising ventures across multiple regions.

- Collaborative Ecosystem – Platforms maintain independence while leveraging shared deal sharing.

Abhilasha Dafria, CEO of Angels Den, highlights the significance of the pilot:

"This milestone represents an exciting new chapter for Angels Den and points toward the future of crowdfunding. Dacxi Chain's technology allows us to extend opportunities beyond the UK, giving our entrepreneurs international exposure while maintaining all necessary regulatory controls. This is precisely the kind of innovation our industry needs."

Janis Blazevics, CEO of Crowded Hero, shares his perspective on the long-term implications:

"By enabling platforms to collaborate across borders, Dacxi Chain addresses one of crowdfunding's fundamental challenges. This pilot demonstrates that international investment flow is not just possible but practical. We're seeing firsthand how this can expand opportunities for entrepreneurs and investors alike. The potential for industry transformation is significant."

Building the Infrastructure for Global Investment

Rather than competing with other platforms, Dacxi Chain provides the underlying technology that enables global collaboration:

- Platform-agnostic infrastructure connects licensed crowdfunding services.

- Secure cross-border referral system maintains transparency and compliance.

- Technology bridges different regulatory environments without compromising legal requirements.

Craig Smith-Gander, CEO of Dacxi Chain, explains the vision behind this milestone:

"This successful pilot represents the first step in what we believe will become the new standard for crowdfunding. Following this proof of concept, we're already establishing additional pilots across Europe, with early discussions underway in the United States. Our goal is to create an interconnected global ecosystem that unlocks the full potential of equity crowdfunding."

Expanding the Vision

Building on this initial success, Dacxi Chain is actively expanding its network:

- Additional European platforms are being onboarded for upcoming pilots.

- Early discussions have begun with US-based crowdfunding services.

- The technology framework is being refined based on insights gained from the first 'live' deal sharing.

The cross-border pilot between Angels Den and Crowded Hero demonstrates that global crowdfunding is evolving from concept to reality, with Dacxi Chain providing the technological foundation to make it possible.

About Dacxi Chain

Dacxi Chain develops innovative technology infrastructure that enables seamless cross-border collaboration between licensed crowdfunding platforms. By building a global investment network, Dacxi Chain is helping reshape how entrepreneurs and investors connect, creating a more efficient, accessible, and collaborative funding ecosystem.

Media Contact:

PR Team, Dacxi Chain

Email: [email protected]

Dacxi Chain Q1 2025 Update: Pioneering Cross-Border Equity Crowdfunding

The first quarter of 2025 has been transformative for Dacxi Chain, marking several milestone achievements in our mission to revolutionize global equity crowdfunding. As we continue building the infrastructure for truly borderless investment, we’re pleased to share our progress and vision for the future.

Historic First: Cross-Border Equity Crowdfunding Transaction Completed

In what represents a significant industry breakthrough, Dacxi Chain successfully facilitated the first-ever compliant cross-border equity crowdfunding transaction. This wasn’t a test case or simulation—it was a live transaction involving licensed platforms, verified investors, and real capital.

This historic pilot connected two companies in the EU, demonstrating that international collaboration between licensed crowdfunding platforms is not just possible but practical. While we’ll share more details once the transaction fully closes, this achievement stands as a meaningful validation of the cross-border model, proving its feasibility within existing regulatory frameworks.

Building the Infrastructure for Global Investment

To support our expanding network, we’ve launched the Dacxi Chain portal – an operational interface that connects platforms and facilitates deal sharing across jurisdictions. This technology allows locally licensed crowdfunding platforms to share both deals and investors across borders while maintaining regulatory compliance.

We’ve also activated the initial phase of our blockchain infrastructure, which underpins transaction tracking and settlement. Future phases will support tokenized equity and custody solutions, further enhancing the capabilities of our global investment network.

Strategic Partnerships Across Europe

The European Union, with its harmonized regulations, provides a strong foundation for cross-border collaboration. We’ve secured multiple pilot partners across the EU this quarter, with more platforms expressing interest in joining our network.

These partnerships are crucial to our network strategy. Rather than being constrained by regulatory and currency issues, we’re enabling platforms to conduct pilot deals that demonstrate the value of cross-border collaboration. Each success increases visibility, attracts media coverage, and accelerates the network effect.

Global Equity Crowdfunding Alliance (GECA) Momentum

Dacxi Chain continues to support the work of GECA, which has become a key driver of the broader movement toward cross-border equity crowdfunding. Although GECA operates independently from Dacxi, its growth plays a vital role in expanding our network.

GECA’s momentum in Q1 has been exceptional, now including more than 50 supporters spanning platform leaders, national crowdfunding associations from the UK and Africa, and senior figures involved in shaping crowdfunding regulation across the EU and the United States.

Looking ahead to Q2, GECA aims to double its supporter base to 100, with a clear focus on Europe and North America – regions that together represent over 90% of global crowdfunding volume. As further evidence of its growing influence, GECA’s steering committee lead will be a featured speaker at the US Crowdfunding Conference in May 2025.

Expanding Our Global Footprint

The second half of 2025 will focus on building the Dacxi Chain network across key regions:

- In the EU, we’re expanding through pilot programs designed to test and refine cross-border deal sharing

- A sector-specific initiative in green crowdfunding is already underway

- In the United States, we’ve begun the early stages of launch, engaging with platforms and industry leaders to develop a region-specific network model

As activity ramps up, we’ll move toward launching version two of the platform, which will support tokenized equity transactions, bringing even greater efficiency and accessibility to the global investment ecosystem.

The Vision: A Global, Frictionless Investment Network

Our long-term vision remains clear: creating a global, frictionless investment network where a deal originating in one country can be invested in from anywhere in the world.

Today’s market is fragmented. Platforms are licensed only to promote deals domestically, constrained by varying regulations. Rather than collaborating, platforms often compete, limiting growth across the sector. Dacxi Chain is changing this paradigm.

We see global crowdfunding as a space with the potential to grow from a $1 billion niche into a $100 billion mainstream sector. The need for a solution is widely acknowledged, and Dacxi Chain is focused on delivering the technology to make it possible.

Looking Forward

Q1 2025 has delivered foundational progress through live execution, infrastructure deployment, and strategic partnerships – laying the groundwork for the next stage of development.

The entire Dacxi Chain team is exceptionally optimistic about our trajectory. By connecting locally licensed crowdfunding platforms into a global network, we’re addressing one of the sector’s biggest limitations: restricted access to broader, more diverse investor networks.

As we continue to build and expand in 2025, we invite you to follow our journey toward making truly global equity crowdfunding a reality.

To stay up to date with Dacxi Chain’s progress, connect with us through our official channels and subscribe to our newsletter.

- News and Updates: We’ll continue to share developments as we progress. Your engagement is invaluable.

- Community Engagement: Join discussions, provide feedback, and collaborate with like-minded individuals committed to innovation.

The New Era of European Integration: Why Dacxi Chain is Uniquely Positioned for the Future of Equity Crowdfunding

The world economy is entering a transformative era. As European Commission President Ursula von der Leyen outlined in her speech at the World Economic Forum, the landscape of global trade, energy, and capital flows is being redefined. Her rallying cry for deeper EU integration, stronger capital markets, and a push for innovation provides a powerful backdrop for why the Dacxi Chain is poised to lead in this new reality.

A Fractured Global Economy: The Opportunity for Regional Strength

Von der Leyen noted that while the world remains connected, it has begun “fracturing along new lines.” The cooperative global order that once defined economic strategies is giving way to sharper geostrategic competition. This shift creates an urgent need for Europe to strengthen its internal economic frameworks – and nowhere is this more evident than in capital markets.

Dacxi Chain’s vision aligns perfectly with the Commission’s focus on breaking down barriers and creating unified systems. By connecting equity crowdfunding platforms across borders, Dacxi Chain helps innovative companies access a wider pool of investors and provides European citizens with the opportunity to back ventures that align with their vision for the future.

Europe’s Savings and Investment Gap: A Game-Changing Solution

Von der Leyen highlighted a critical issue: while Europe does not lack capital, much of its €300 billion in annual savings flows overseas. This capital leakage stifles the growth of early-stage technologies and innovative companies within the EU.

Dacxi Chain directly addresses this challenge by creating a decentralized, cross-border ecosystem for equity crowdfunding. Our platform makes it easier for investors to find promising opportunities across Europe while giving startups the funding they need to scale. This aligns with the Commission’s proposed “savings and investments union,” ensuring that Europe’s wealth is reinvested into its own innovative economy.

Unifying Europe’s Capital Markets with Technology

The European Commission’s call for dismantling barriers within the single market echoes Dacxi Chain’s mission to integrate equity crowdfunding platforms. By implementing blockchain, AI, and other advanced technologies, Dacxi Chain facilitates seamless collaboration among platforms, transcending national borders and regulatory complexities.

This unified system empowers crowdfunding platforms to share deals, co-create opportunities, and scale investor access – all under a transparent, rules-based framework. As von der Leyen emphasized, “With Europe, what you see is what you get. We play by the rules.” Dacxi Chain embodies this ethos by providing a secure and transparent network that inspires trust among investors and issuers alike.

Driving Climate Innovation Through Equity Crowdfunding

The European Commission’s commitment to the Paris climate agreement underscores the need for innovative, green solutions. Equity crowdfunding is uniquely positioned to fund these innovations, connecting mission-driven investors with startups focused on sustainability.

Dacxi Chain amplifies this potential by enabling platforms to highlight and share high-impact, environmentally focused deals across Europe. This approach ensures that game-changing projects in renewable energy, green technology, and sustainable practices find the capital they need to thrive.

Why Dacxi Chain is the Future of European Equity Crowdfunding

Dacxi Chain is more than a platform—it’s a catalyst for change in the European funding ecosystem. Our decentralized network supports von der Leyen’s call for stronger, more integrated capital markets by:

- Breaking Down Borders: Connecting equity crowdfunding platforms across Europe to create a unified marketplace for investors and issuers.

- Leveraging Technology: Utilizing blockchain for transparency, AI for deal matching, and APIs for seamless platform integration.

- Empowering Innovation: Ensuring that Europe’s savings are reinvested into its own startups, driving economic growth and sustainability.

The Path Forward: Collaboration and Vision

As von der Leyen stated, “We will need to work together to avoid a global race to the bottom.” Collaboration is at the heart of Dacxi Chain’s model. By fostering cooperation between equity crowdfunding platforms, investors, and issuers, we are building a network that doesn’t just compete – it elevates.

The future of Europe lies in its ability to innovate, adapt, and integrate. With its decentralized, collaborative approach, Dacxi Chain is ready to lead the charge in transforming equity crowdfunding into a cornerstone of the EU’s economic strategy.

Join the Movement

As Europe redefines its economic future, there has never been a better time to join the Dacxi Chain network. Together, we can unlock new opportunities, empower innovation, and drive growth across borders. Let’s shape the future of equity crowdfunding – one deal at a time.

Stay Connected

- News and Updates: We’ll continue to share developments as we progress. Your engagement is invaluable.

- Community Engagement: Join discussions, provide feedback, and collaborate with like-minded individuals committed to innovation.

Dacxi Blockchain: A Milestone in Global Innovation Funding

We are thrilled to announce the successful launch of the Dacxi Blockchain, a major milestone in building the infrastructure for cross-border, global crowdfunding. This development is pivotal to realizing our vision of a decentralized innovation investment ecosystem.

Key Highlights of the Dacxi Blockchain

The Dacxi Blockchain is a Layer 2 blockchain built on the Ethereum network. It joins the ranks of other prominent Layer 2 platforms, such as Polygon, Coinbase’s Base, and Sony’s Sonieum.

As a Layer 2 solution, the Dacxi Blockchain enables the development of specialized features and cost efficiency while benefiting from Ethereum’s industry-leading infrastructure. It is also designed to support widespread decentralization, accommodating thousands of validators globally. This decentralization is essential for meeting the demands of a massive global innovation investment ecosystem, which requires absolute security and localized controls critical for compliance and investor trust.

Understanding Application-Specific Blockchains (ASBs)

To understand the design of the Dacxi Blockchain, it is important to distinguish between two primary types of blockchains:

- General Infrastructure Blockchains (GIBs):

These blockchains, such as Ethereum, Solana, and Polygon, are designed to host any application (DApps) across various sectors. They compete on transaction speed, fees, security, features, and community support. - Application-Specific Blockchains (ASBs):

ASBs, like the Dacxi Blockchain, are purpose-built for specific industries or ecosystems, such as gaming, media, or finance. This targeted approach allows for tailored designs that prioritize the unique requirements of their target market.

The Dacxi Blockchain is the ASB created specifically for the global innovation investment ecosystem. It is optimized for tokenizing shares and facilitating atomic swaps (share tokens for Dacxi Coins). This design ensures that the Dacxi Blockchain is more secure, efficient, faster, and cost-effective.

The Dacxi Blockchain does not compete with GIBs within the Dacxi Chain global innovation funding ecosystem. This means efforts are not wasted on unnecessary developments, and it is not subject to the fee pressures of GIBs—positively impacting the Dacxi Coin’s market capitalization and staking solution.

Strategic Timeline for Development

- Testnet (H1 2025):

- Development of the blockchain is conducted privately and not publicly presented.

- Smart contracts for tokenized shares and atomic swaps undergo rigorous testing.

- Block validation is managed directly by Dacxi to ensure quality control.

- Mainnet Launch (H2 2025):

- Tokenized shares go live, enabling secure and instant transactions via atomic swap contracts.

- Staking is introduced, decentralizing block validation to enhance security and scalability.

- Expansion Phase:

- Additional features include new tokenised assets, wallets for coins and tokens, and expanded validator networks.

- Capabilities for investor registration, cap table management, and secondary markets drive transaction volumes, platform adoption, and ecosystem growth.

Dacxi Coin

The upgraded Dacxi Coin operates within the Ethereum ecosystem and includes special features tailored to the Dacxi Blockchain, especially staking. A key advantage of remaining within the Ethereum system is the ease of listing the Dacxi Coin on exchanges and its compatibility with wallets.

Notably, there will be no requirement to “swap” the new coin for another when the Mainnet is launched. Once operational, transaction fees on the Dacxi Blockchain will be paid exclusively in Dacxi Coin, and staking will also utilize the coin.

The Bigger Picture: A New Era for Innovation Funding

The launch of the Dacxi Blockchain represents a significant step forward in building a global innovation funding ecosystem. By tokenizing equity and facilitating secure transactions, the Dacxi Blockchain establishes the foundation for a future where innovation transcends borders.

This is not just a technological achievement—it reflects the culmination of seven years of careful planning and development to ensure the timing and execution were precise. While this marks the beginning of a journey, the implications are profound: the Dacxi Blockchain has the potential to redefine how innovation is funded and supported worldwide.

Rock on, Dacxi!

Stay Connected

- News and Updates: We’ll continue to share developments as we progress. Your engagement is invaluable.

- Community Engagement: Join discussions, provide feedback, and collaborate with like-minded individuals committed to innovation.

The DXI Difference: Unveiling the Next Generation of Global Crowdfunding

In the rapidly evolving landscape of blockchain and cryptocurrency, staying ahead isn’t just about innovation—it’s about revolutionizing industries. At Dacxi Chain, we’re not merely part of the change; we’re leading it. With the imminent launch of our new Dacxi Coin (ticker – DXI) and the accelerated development of our Web3 Dacxi Chain, we’re poised to transform the global equity crowdfunding world.

A New Era with Web3 Dacxi Chain

The Dacxi Chain is advancing at an unprecedented pace. As the only decentralized solution specifically designed for global innovation funding, we’re tackling the inherent challenges of traditional equity crowdfunding by leveraging cutting-edge blockchain and AI technology.

Our mission is clear: to create a borderless, efficient, and accessible platform that empowers entrepreneurs and investors worldwide.

Building the Future Today: Current Developments

We’re proud to share the significant strides we’re making:

1. Launching the Dacxi Blockchain in Q4.

We’re creating a new blockchain—a Layer 2 solution based on Ethereum. Utilizing zk-rollups, our state-of-the-art, application-specific blockchain is dedicated exclusively to the global innovation funding ecosystem. This specialization grants us unparalleled control over security and functionality, ensuring an optimized environment for our users.

2. Launching Dacxi Coin (DXI) Now

A new blockchain necessitates the upgrade of our previous token. The introduction of Dacxi (DXI) marks a substantial evolution from the old Dacxi Coin (DACXI). This new coin is essential for powering transactions on the Dacxi Blockchain and unlocking future features like blockchain fees, governance, and staking.

3. Global Community Building with GECA

All equity crowdfunding platforms agree that the future of the industry is global, enabled by blockchain technology. However, many are still exploring how to make this vision a reality and are eager to learn and discuss ideas before committing to implementation. To facilitate this crucial dialogue, we have established the Global Equity Crowdfunding Alliance (GECA)—a rapidly growing consortium for platforms and suppliers dedicated to shaping the future of global equity crowdfunding.

GECA serves as a collaborative hub where industry participants can come together to share insights, explore innovative solutions, and address the challenges of creating a borderless crowdfunding ecosystem. With membership numbers rapidly approaching critical mass, GECA is fostering a vibrant community through active discussion forums, insightful content, and regular collaborative events. By uniting the industry under a common vision, GECA provides the platform for learning and discussion that is essential for platforms to confidently embrace global equity crowdfunding. Through GECA, we are accelerating the transition to a seamless, borderless crowdfunding environment, empowering platforms worldwide to actualize the future they envision.

4. Pioneering Platform Engagements

We’re actively pioneering deal flow between platforms without relying on blockchain use. This approach allows us to build a robust network that will seamlessly transition into our next development stage, solidifying relationships and trust across the industry.

Looking Ahead to 2025: Tokenized Transactions and Staking

In 2025, we’ll continue our expansion of GECA and pioneering platform deals then will move onto the next phase adding:

Tokenized Transactions Using Dacxi (DXI)

We’ll launch tokenized equity on the Dacxi Blockchain for transactions also utilizing Dacxi (DXI) for international investments. This innovation will streamline cross-border transactions, making them faster, more secure, and more accessible than ever before.

Mainnet Launch and Staking

The Dacxi Blockchain will transition from testnet to mainnet, marking a significant milestone. With the mainnet launch, we’ll enable a staking program, allowing coin owners the opportunity to participate in network security and earn staking rewards.

More details are available in the Dacxi whitepaper.

The Dacxi Blockchain: Cutting-Edge Technology

Our new Dacxi Blockchain is a Proof-of-Stake (PoS) Layer 2 blockchain built on Ethereum, employing zk-rollups for enhanced scalability and efficiency. This technology is at the forefront of the industry, similar to solutions launched by leaders like Polygon and Coinbase’s Base.

By creating an application-specific blockchain, we ensure our platform is tailored exclusively for the global innovation funding world. This focus provides us unmatched control, enabling us to customize features to meet the unique needs of our users while maintaining the highest security standards.

Staking: Securing Our Blockchain

Staking is more than a feature—it’s a necessity for the security and resilience of our global blockchain. Our ecosystem will require thousands of validator nodes, impacting the scale of the staking program. For perspective, Ethereum has around 14,000 nodes, and Solana has about 5,000.

Why Staking Matters:

- Risk Mitigation: By requiring participants to stake their Dacxi (DXI), we enhance the network’s security and integrity, making it more resilient against attacks.

- Network Decentralization: A large number of nodes contribute to a more decentralized and robust blockchain, aligning with the core principles of blockchain technology.

- Incentivization: Stakers earn rewards, encouraging active participation and fostering a committed community.

Our projections indicate that the staking market cap has the potential to place us in the top 20 globally. Currently, excluding the top three, the average top 20 staking market cap is around $3.5 billion, with 50% of coins staked and offering approximately 8% annual returns.

Introducing Dacxi (DXI): A Necessary Evolution

The upgraded Dacxi Coin, now called DXI, is essential for our blockchain’s functionality and growth. It has five primary use cases within the Dacxi Chain ecosystem:

Primary Uses of Dacxi (DXI):

- International Transactions

Dacxi (DXI) facilitates international investment transfers across the Dacxi Chain network. It offers rapid, secure, and cost-effective fund movement compared to traditional fiat and stablecoin systems—essential for global crowdfunding. - Blockchain Fees

Similar to Ethereum’s ETH, Dacxi (DXI) is used to pay transaction fees on the Dacxi Blockchain, ensuring the network’s sustainability and incentivizing node operators. - Blockchain Staking

Dacxi (DXI) is integral for staking on the Dacxi Blockchain. Participants can stake their coins to support network security and earn rewards, promoting long-term engagement. - Governance

Ownership of Dacxi (DXI) empowers holders to participate in governance decisions, giving our community a voice in shaping the platform’s future. - Exchange Currency

Dacxi (DXI) supports transactions on tokenized secondary exchanges, providing liquidity for tokens launched on the Dacxi Chain and enhancing the overall ecosystem.

The Dacxi (DXI) Difference: What Sets Us Apart

Several factors distinguish Dacxi (DXI) from its predecessor and other cryptocurrencies:

1. Appeal to Major Listings

Dacxi (DXI) is strategically positioned to attract major exchange listings due to:

- Credibility and Development: Unlike projects that promise eventual launch, the Dacxi Chain is a tangible reality with ongoing developments and consistent news updates. This established credibility enhances the coin’s appeal to major exchanges and investors.

- Demand Potential: Our ecosystem’s coin demand potential is substantial. With expanding partnerships, diverse deal types, and a growing investor base, we’re unlocking a $1 trillion market, handling $100 billion in annual transactions.

- Understanding of Blockchain Fees: The crypto market recognizes the value of a coin used for blockchain fees. Owning our blockchain allows us to protect fee structures, ensuring sustainable revenue and market cap stability.

2. Exponential Ecosystem Growth

The demand for a coin is based on the potential demand from its ecosystem. Dacxi’s ecosystem is poised for exponential growth:

- Global Partnerships: We’re onboarding platforms worldwide, enhancing our reach and amplifying the network effect.

- Diverse Deals and Investors: By facilitating a wide range of deals, we attract a broader investor base, driving demand for Dacxi (DXI).

3. Control Over Blockchain Fees

Owning our blockchain means:

- Fee Protection: We can maintain reasonable fees that reflect the value provided, unlike open networks where competition drives fees down, potentially eroding market cap.

- Sustainability: Controlled fees ensure the network’s long-term viability and profitability.

4. Impact of Staking

Staking profoundly influences market dynamics:

- Supply Reduction: With the potential for 50% of Dacxi (DXI) to be staked, a significant portion of the supply will be out of circulation, increasing coin scarcity.

- Market Cap Growth: High staking levels can substantially elevate the market cap, enhancing investor confidence and interest.

5. Integration of AI Technology

Our AI initiatives, set to be announced in 2025, are expected to revolutionize crowdfunding:

- Increased Deals and Investors: AI will dramatically scale the number of deals and investors, enhancing platform activity.

- Exponential Transaction Growth: More transactions mean increased demand for currency transfers, blockchain fees, and staking—driving Dacxi (DXI)’s value.

Dacxi Chain Credibility and Industry Recognition

Our advancements aren’t happening in isolation. The global industry recognizes the underlying problems we’re solving:

- Global Engagement: Through GECA, platforms worldwide acknowledge the necessity of a borderless crowdfunding solution.

- Execution of Plans: We’re not just planning—we’re executing, providing tangible results and reinforcing confidence in our vision.

This credibility sets us apart from the vast majority of coins where underlying demand and utility are often questioned.

Join Us in Shaping the Future of Global Crowdfunding

The DXI Difference is more than technological advancement—it’s about democratizing access to innovation funding and empowering a global community.

Why Be Part of Dacxi Chain?

- Innovative Solutions: We’re addressing critical industry challenges with practical, forward-thinking strategies.

- Global Impact: By bridging gaps between investors and opportunities worldwide, we’re fostering an inclusive and dynamic market.

- Unique Opportunities: Whether you’re an investor, platform, or enthusiast, Dacxi Chain and Dacxi (DXI) offer unparalleled opportunities to participate in a transformative movement.

Conclusion: Embracing the Dacxi (DXI) Difference

The launch of Dacxi (DXI) and the advancements of the Dacxi Chain mark a pivotal moment in the evolution of global crowdfunding. By combining cutting-edge blockchain technology, strategic staking mechanisms, and forthcoming AI integration, we’re not just predicting the future—we’re actively building it.

The DXI Difference lies in our unique positioning:

- A Specialized Blockchain: Tailored exclusively for global innovation funding, offering unmatched control over security and functionality.The coin powers this blockchain.

- Strategic Ecosystem Growth: With a rapidly expanding global network and partnerships, we’re creating robust demand for Dacxi (DXI).

- Market Impact through Staking: High staking levels reduce supply and can significantly elevate market cap, enhancing value for all stakeholders.

We invite you to join us on this exciting journey. Together, we’re redefining possibilities and creating a legacy in the world of innovation funding. Embrace the Dacxi (DXI) Difference and be a part of the future today.

Stay Connected

- News and Updates: We’ll continue to share developments as we progress. Your engagement is invaluable.

- Community Engagement: Join discussions, provide feedback, and collaborate with like-minded individuals committed to innovation.

Dacxi Chain at Euro CrowdCon 2024: Pioneering the Future of Global Equity Crowdfunding

Brussels buzzed with energy as the equity crowdfunding elite gathered for Euro CrowdCon 2024. Among industry giants like Republic and Crowdcube, representatives from Dacxi Chain were honored to take the stage. Our mission? To share a bold vision for the future of global equity crowdfunding—and the atmosphere was nothing short of electrifying.

The Convergence of Minds at Euro CrowdCon 2024

Euro CrowdCon 2024 was more than just an industry event; it was a crucible for innovation where groundbreaking ideas met actionable strategies. Leaders, innovators, and enthusiasts from around the world convened in Brussels’ historic conference halls.

As proud sponsors of this landmark event, our team engaged in a transformative fireside chat with Oliver Gajda, Executive Director at Eurocrowd. The discussion delved deep into the inevitability of global equity crowdfunding, the pivotal role of technology—particularly blockchain and AI—and the collaborative efforts needed to harmonize regulations across borders.

A key message that resonated with the audience was that blockchain tokenization finally solves the scaling issues and unlocks the expansion opportunities of cross-border crowdfunding. This technology can unleash the full potential of the equity crowdfunding business model, potentially scaling it 100 times over. We emphasized that the time has arrived for this transformation—the technology exists, and Dacxi Chain has emerged as a leader in this space. However, to realize this future, industry stakeholders must actively get involved. By embracing blockchain tokenization now, platforms can significantly expand the size of the industry and transform their businesses.

Dacxi Chain: Redefining the Equity Crowdfunding Landscape

Our mission at Dacxi Chain is clear: to serve as a catalyst for global equity crowdfunding. Drawing on decades of industry experience—including aiding in the listing of innovative companies on European exchanges and partnering with businesses across the continent—we are passionate about pioneering solutions that empower the industry.

In 2017, inspired by the transformative potential of blockchain technology, we launched Dacxi Chain with the goal of building a global network of interconnected platforms. We recognized that acceptance of blockchain would take time, and we’ve patiently awaited the maturation of critical technological developments like proof of stake and other advancements that enhance scalability and efficiency.

By positioning ourselves as the “Intel Inside” of crowdfunding, we provide the technological backbone that enables local platforms to achieve global reach. Our solutions are designed to integrate seamlessly, offering the infrastructure needed to navigate the complexities of cross-border investment.

The Imperative of Global Expansion: Why Now?

Global equity crowdfunding is no longer a distant aspiration; it is an imminent reality. Investors and entrepreneurs worldwide share a universal desire for cross-border investment opportunities. The technology to facilitate this expansion is already at our fingertips; the challenge lies in navigating the complex regulatory landscape.

“Regulatory issues are clear,” we acknowledged during our chat with Oliver Gajda, “but we believe that all of these can be addressed if the necessary protections exist.” We advocate for pioneering efforts to explore current possibilities, co-create solutions, and collaborate closely with policymakers to achieve regulatory harmonization. This collective effort promises significant rewards for all stakeholders involved.

Leveraging Technology: Blockchain and AI as Catalysts

Technology is the linchpin in transforming equity crowdfunding into a truly global marketplace. At Dacxi Chain, we leverage our expertise in blockchain, tokenization, and cryptocurrency—skills honed over years of dedicated development—to build robust platforms and integrate payment systems worldwide.

“Blockchain is simple,” we explained. “It’s a new type of database where ownership and transactions are inherently trusted.” This trustless system ensures secure, transparent transactions and ownership records, which are essential for cross-border investments.

We also highlighted the burgeoning role of artificial intelligence (AI) in equity crowdfunding. Beyond enhancing customer service and campaign effectiveness, AI has the potential to empower investors through personalized AI agents. These agents can significantly scale the number of investors and, more importantly, instill confidence to invest in multiple deals.

Balancing Regulatory Progress with Technological Innovation

While technology advances at a rapid pace, regulatory frameworks often lag behind. We acknowledged the extensive journey of the European Crowdfunding Service Providers Regulation (ECSPR) and the ongoing efforts toward regulatory convergence. “Regulatory compliance is not negotiable,” we stressed, but we also pointed out that existing regulations were not initially designed with cross-border crowdfunding in mind.

To bridge this gap, we advocate for proactive engagement with regulators and policymakers. “We have to be pioneers to prove what’s possible,” we stated. By demonstrating the potential economic benefits—such as job creation and wealth generation—industry players can influence political will and drive regulatory changes that facilitate global crowdfunding.

Navigating Regulatory Complexity in Global Markets

Expanding into global markets involves navigating a complex web of regulatory requirements across different jurisdictions. We collaborate with local partners who possess in-depth knowledge of their respective legal landscapes. “You know your local laws,” we emphasized. “These cannot be disregarded.”

Through cooperative efforts and adherence to compliance checklists, platforms can find interim solutions that, while not perfect from a user experience standpoint, allow them to “prove the concept” and pave the way for more streamlined approaches in the future.

Overcoming Profitability Challenges and Refining Business Models

Scaling to profitability remains a significant challenge for many crowdfunding platforms. We propose that cross border crowdfunding holds the key to unlocking scalability, identifying three critical factors:

- Access to Exciting Deals and Capital: There is no shortage of compelling investment opportunities or investors with capital. The challenge lies in attracting deals that can compete with, or complement, traditional venture capital offerings. Equity crowdfunding offers entrepreneurs the advantage of maintaining control while accessing capital more easily through a global investor base.

- Investor Engagement Beyond Local Deals: Platforms often focus narrowly on investments in their own deals rather than maximizing the potential from their investor base. By offering investors a steady flow of deals aligned with their interests—such as medical professionals investing in healthcare startups globally—platforms can enhance investor engagement and increase investment frequency.

- Scaling Operations: Without sufficient scale, senior personnel may become bogged down in time-consuming deal processes. A global network allows for operational scaling, freeing up resources to focus on strategic growth and investor relations.

Trust and Transparency: Cornerstones of a Global Network

Trust is the foundation of successful crowdfunding, especially on a global scale. Blockchain technology plays a crucial role by enabling a “zero-trust” environment where transactions and ownership are inherently secure. However, we caution that technology addresses only the transactional layer.

Establishing trust in deal standards and ensuring that offerings are accurate and credible is even more vital. We address this through the co-creation of standards and expectations, leveraging the collective power of the network to enforce compliance. Platforms that fail to adhere to these standards risk exclusion, which would significantly impact their market competitiveness.

To formalize these efforts, we support the Global Equity Crowdfunding Alliance (GECA), an independent body governed by a steering committee comprising industry leaders worldwide. GECA serves as a platform for co-creating industry standards and regulations, fostering a deeper understanding of the challenges we face. By building confidence among stakeholders, GECA represents a vital first step toward harmonizing global crowdfunding practices. Collaborating with local partners and regional organizations like Eurocrowd, GECA works to establish and uphold these industry standards, ensuring a consistent and trustworthy environment for all participants.

Harmonizing Global Regulations Beyond Europe

While the European Union has made significant strides with ECSPR, we recognize that “nowhere else is the sector as developed as the EU.” Other regions express interest in harmonization but face challenges due to a lack of coordination and confidence.

GECA aims to address these challenges by conducting research and publishing findings that underscore the necessity of regulatory harmonization—not just from a platform perspective but also considering investor interests. By presenting data-driven insights, GECA seeks to foster global collaboration and alignment in regulatory frameworks.

The Role of Governments and Regulators in Fostering Global Crowdfunding

We distinguish between the roles of governments and regulators. Regulators are responsible for overseeing compliance and maintaining market stability, while governments—particularly policymakers—should actively support the crowdfunding sector due to its potential to drive innovation and create high-paying jobs.

“We need to lobby by presenting them with research, opportunities, and solutions,” we asserted. By demonstrating tangible economic benefits, industry stakeholders can encourage governments to champion policies that facilitate global equity crowdfunding.

Embracing the Future: Global Equity Crowdfunding is Inevitable

Looking ahead, we envision an optimistic trajectory for the crowdfunding industry. Global equity crowdfunding is inevitable due to the universal desire for cross-border investment opportunities and the technological capabilities ready to support them. Blockchain and AI will be instrumental in powering this future, enabling platforms to manage an estimated 100 million investors and $100 billion in transactions.

The challenges lie in believing what’s possible and engaging in the co-creation of solutions. We emphasize the importance of collaboration over competition within the industry, as the real competitors are traditional venture capital firms and prevailing investor confidence levels.

At Dacxi Chain, we aspire to “catalyze the process and provide the tech infrastructure” for this decentralized network. The potential benefits are substantial, offering opportunities for initial funding, follow-on funding, coaching, and fostering vibrant investor communities.

Conclusion: Join Us in Shaping the Future

Our experiences and insights shared at Euro CrowdCon 2024 underscore a pivotal moment for the equity crowdfunding industry. The convergence of technology, investor enthusiasm, and collaborative efforts to harmonize regulations signal a clear path toward a global crowdfunding marketplace.

We invite stakeholders—including eFC partners, and industry peers—to join us. Engage with initiatives like the Global Equity Crowdfunding Alliance (GECA) or explore collaborations with us at Dacxi Chain. Your involvement can reshape the industry and unlock unprecedented opportunities for innovation, investment, and economic growth.

Join the Movement

Ready to make a significant impact? Everyone knows that blockchain tokenization is the key to scaling and expanding cross-border crowdfunding. The technology exists, and the leader has arrived—but we need you to get involved. Become a supporter of the Global Equity Crowdfunding Alliance (GECA) or sign up as an equity crowdfunding (eCF) partner with Dacxi Chain. Whether you’re an industry veteran or new to the scene, your participation can shape the future of global equity crowdfunding.

Let’s work together to turn possibilities into realities.

Thank you for being part of this exciting journey.

Dacxi Chain to Play Key Role at EUROCROWD's 13th CrowdCon in Brussels

The world of equity crowdfunding is evolving at breakneck speed, and Dacxi Chain is at the forefront of this transformative movement. We are thrilled to announce that Dacxi Chain will sponsoring and speaking at the 13th CrowdCon & 4th Fintics Joint Conference, hosted by Eurocrowd on September 26th & 27th, 2024, in Brussels. This landmark event, titled “Financial Fusion: Bridging Gaps, Embracing Innovation, and Shaping the Future,” is set to gather the most influential leaders in the crowdfunding and fintech space, providing a critical platform for thought-provoking discussions and industry-shaping insights.

Fireside Chat: Is It Too Early to Think Global?

At 4:30 PM, on day one, Dacxi Chain will be featured in a Fireside Chat with Oliver Gajda, Executive Director at Eurocrowd. “The Final Frontier – Is It Too Early to Think Global?”, promises to be an engaging conversation which will focus on the potential benefits and challenges of expanding crowdfunding platforms beyond national borders. Given Dacxi Chain’s mission to create a global, interconnected crowdfunding ecosystem, this session promises to be a must-attend for anyone interested in the future of global finance.

At Dacxi Chain, we believe the future of crowdfunding is borderless. Our mission to link crowdfunding platforms across regions and continents via blockchain technology aligns seamlessly with the discussions planned at CrowdCon. By creating a secure, transparent, and scalable global crowdfunding network, we empower both entrepreneurs and investors to connect with new markets, unlocking untold capital-raising opportunities.

Dacxi Chain on the Panel: Shaping the Future of Crowdfunding

At 9:20 AM on Day 2, Dacxi Chain will join an esteemed panel of experts to discuss “What’s Next? Crypto Assets, DLT & Securitization in Crowdfunding”. The session will explore how emerging technologies, such as crypto assets and distributed ledger technology (DLT), are poised to revolutionize the crowdfunding landscape. Moderated by Reid Feldman, Partner at Kramer Levin, this panel will include key industry figures such as Joachim Schwerin, Principal Economist at the European Commission, and Andreas Knopf, General Counsel at Invesdor. Together, these experts will discuss the potential and challenges of integrating these technologies into mainstream crowdfunding.

Dacxi Chain’s role in developing a borderless crowdfunding ecosystem fits perfectly with the theme of this discussion, as we explore how global networks, tokenization, and decentralised finance (DeFi) are transforming the traditional crowdfunding model.

Why Eurocrowd’s CrowdCon Matters

Jointly hosted by Eurocrowd and 4th Fintics by the Digital Lending Association, CrowdCon is a pivotal event for the European crowdfunding sector. For over a decade, Oliver Gajda and his team have brought together the most active platforms, policymakers, and thought leaders, making CrowdCon the premier gathering for industry insiders. This year’s conference, , will feature discussions on regulatory convergence, tokenization, digital lending, and the future of cross-border finance.

As a Gold Sponsor of the event, Dacxi Chain is proud to support Eurocrowd in fostering dialogue on the innovations shaping tomorrow’s finance. We are committed to advancing the global equity crowdfunding sector, driving forward the collaborative spirit that underpins the industry’s growth. This year’s theme, “Financial Fusion: Bridging Gaps, Embracing Innovation, and Shaping the Future,” perfectly reflects our mission to break down geographical barriers and expand crowdfunding’s collective power.

Join Us at CrowdCon

CrowdCon isn’t just another conference; it’s where information and education is shared, and policies shaped. The event provides a unique opportunity for Dacxi Chain to showcase our solutions, network with industry leaders, and contribute to shaping the future of the global crowdfunding landscape. If you’re attending, be sure to catch the panels and fireside chat featuring Dacxi Chain.

For those unable to attend, follow us on social media for live updates, insights, and key takeaways from these discussions. And don’t forget to explore Dacxi Chain and discover how we’re transforming the world of crowdfunding through innovative technology.

About Dacxi Chain

Dacxi Chain is the world’s first global equity crowdfunding network, connecting crowdfunding platforms into a unified ecosystem powered by blockchain technology. By eliminating the traditional barriers between investors and entrepreneurs, Dacxi Chain enables platforms to access new markets, diversify revenue streams, and empower innovation on a global scale.

Join Us at CrowdCon and Discover the Future of Crowdfunding!

Event Details:

- Dates: September 26-27, 2024

- Location: Silversquare North, Brussels

- Dacxi Chain Panels:

- 9:20 AM – Panel: What’s Next? Crypto Assets, DLT & Securitization in Crowdfunding

- 4:30 PM – Fireside Chat: The Final Frontier – Is It Too Early to Think Global?

Follow our journey and see how Dacxi Chain is leading the charge towards a borderless crowdfunding future!

You can apply to attend the event here and find out more here

#CrowdCon2024 #DacxiChain #Blockchain #Crowdfunding #EuroCrowd #DLT #CryptoAssets #GlobalFinance #FintechInnovation