Dacxi Chain Announces Landmark Global Crowdfunding Initiative

SYDNEY, AUSTRALIA – Dacxi Chain, a groundbreaking force in the crowdfunding space, today announces the launch of its global platform, powered by cutting-edge blockchain technology. In a strategic move, Dacxi Chain will be the first deal to feature on its platform.

Prominent partners aligning with Dacxi Chain’s vision include Equitise from Australia, Snowball in New Zealand, and Angels Den a key player from the UK’s crowdfunding scene. This powerful alliance solidifies Dacxi Chain’s commitment to reshaping addressing investment accessibility and address growth challenges inherent in the crowdfunding sector.

Ian Lowe, CEO of Dacxi Chain, commented, “Our objective is clear: to catalyze a significant transformation in how crowdfunding operates. With Dacxi Chain, we offer a streamlined conduit for ventures and investors, enabling growth in an industry ripe for innovation.“

With the global crowdfunding market anticipated to exceed $150 billion by 2030, Dacxi Chain’s platform, bolstered by blockchain, stands ready to facilitate efficient cross-border transactions, maximising the sector’s potential.

As Dacxi Chain continues to expand its reach, its core commitment remains steadfast: to democratize investment opportunities and foster worldwide enterprise connectivity, positioning itself as the benchmark in crowdfunding evolution.

To explore Dacxi Chain’s distinctive approach to global crowdfunding, visit dacxichain.com.

– END –

About the Dacxi Chain

Dacxi Chain pioneers the evolution of crowdfunding, introducing the world’s inaugural global equity crowdfunding ecosystem. Harnessing blockchain, we unite diverse crowdfunding platforms, catalyzing an unprecedented connection between visionary entrepreneurs and discerning investors. In this decentralized arena, platforms thrive with amplified reach and scalability, while investors and entrepreneurs experience transparent, accelerated opportunities. A transformative shift in investment dynamics, Dacxi Chain stands unparalleled in its mission to democratize global investment.

For more information about Dacxi Chain and its operations visit dacxichain.com or connect on LinkedIn, Facebook, Twitter and YouTube

Or contact [email protected]

Breaking Boundaries with Dacxi Chain: A New Era in Cross-Border Investments

Bridging the Gap in a World Divided by Borders

In our modern era, we can watch a sunrise on one continent and witness its set on another, or stream a live concert in Paris from the comfort of New York. The marvels of technology make all this possible. Yet, strangely, the world of international finance and cross-border investments lags behind, ensnared in red tape and burdened by obsolete structures that hinder innovation and suppress a global financial marketplace.

This incongruity between technological marvels and stagnant financial barriers has created a significant challenge. This is where Dacxi Chain comes in—a groundbreaking concept designed to shatter these barriers rather than merely navigate around them. It’s more than a product; it’s a vision of a future where borders cease to be barriers, a place where the dream of global equity crowdfunding becomes reality.

The Challenge of Cross-Border Investment

The Dream of Global Reach

Investors around the world aspire to explore new horizons and invest across borders. But too often, this dream is clouded by complex and seemingly insurmountable challenges.

The Complex Web of International Finance

- Inefficiency: Time-consuming money transfers are an anachronism in today’s world, blocking opportunities and undermining trust.

- Costliness: Intermediaries inflate costs, particularly for smaller investors, turning opportunities into liabilities.

- Opacity: The complexity of international finance leads to confusion and mistrust.

- Exclusivity: Small investors are often left out, hampered by complications and expenses.

Together, these barriers stifle the flow of capital, suppress innovation, and dim the prospects of global investment.

Understanding The Cross-Border Investment Challenge

Navigating the Old Way

The traditional path to international investment resembles a confusing maze filled with obstacles and dead ends.

The Impact on the Industry

- Limited Opportunities: Many remain locked out of the global stage, unable to realize their potential.

- High Costs: Expenses pile up, deterring those who would benefit most from worldwide engagement.

- Lost Potential for Entrepreneurs: Visionary entrepreneurs find their dreams restricted by geography.

The time is ripe for a revolution. Dacxi Chain offers an innovative solution to unleash global potential.

The Dacxi Chain: Opening Doors to Global Investment

A New Dawn for Global Equity Crowdfunding

The Dacxi Chain’s emergence is a profound shift within the intricate world of international finance. It’s a transformation, a new beginning that promises to reshape the way the world approaches equity crowdfunding.

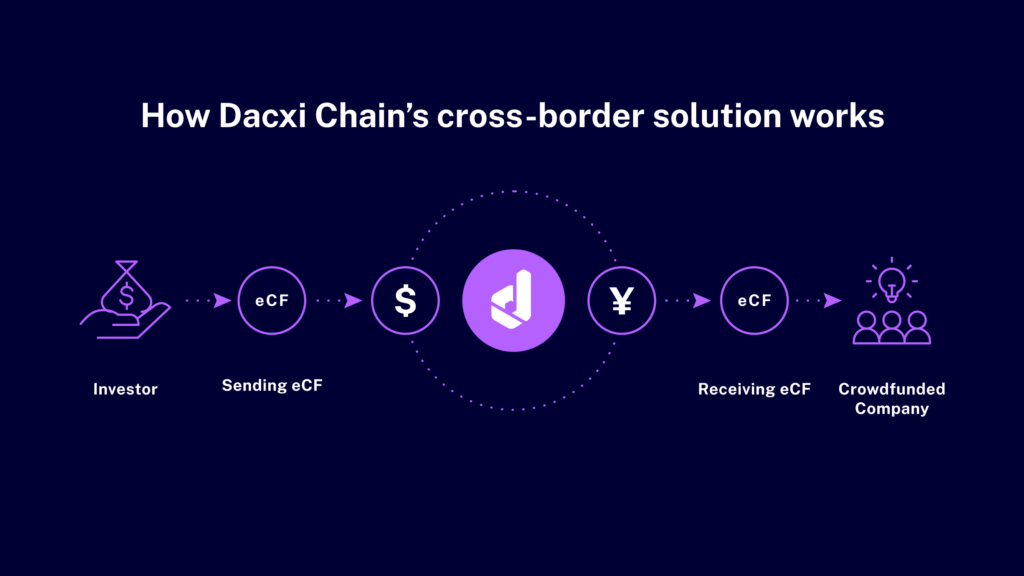

The Process: A Journey Across Borders

- Investor Initiation: An investor, situated in their home country, decides to make an investment in a foreign entity. They pay their local crowdfunding platform in their local currency.

- Local Crowdfunding Platform’s Role: The local crowdfunding company acts as the initial gateway for the investment. It collects the funds from the investor and prepares to send them through the Dacxi chain.

- Conversion into Dacxi Coin: The investment is then sent through the Dacxi chain, where it is converted into Dacxi coin. This transformation acts as an intermediary step, bridging the gap between different currencies. The use of the Dacxi coin ensures that the value of the funds is maintained and that the process is as efficient as possible.

- Conversion into Destination Currency: The Dacxi coin is then converted into the currency of the destination country. This ensures that the funds are accessible and usable in the country where the receiving crowdfunding company operates.

- Receiving Crowdfunding Company’s Role: The funds are received in the destination country by the local crowdfunding company. This entity plays a crucial role in funnelling the investment to its final target.

- Deposit with the Issuing Company: The final step involves the receiving crowdfunding company depositing the funds with the issuing company that the investor has chosen to invest in. This completes the process, allowing the issuing company to utilize the investment according to their business needs.

Key Advantages and Benefits

- Simplicity: Despite the complexity of international fund transfers, this process simplifies it for the investor, who only needs to deal with their local currency and crowdfunding platform.

- Efficiency: The use of the Dacxi coin as a universal intermediary accelerates the transfer, ensuring that funds reach their destination promptly.

- Cost-Effectiveness: By streamlining the conversion process, costs can be minimized,making it an attractive option for both investors and businesses.

- Global Reach: This network connects investors and companies across different countries and currencies, providing unprecedented access to global investment opportunities.

The Impact and Future of Dacxi Chain

Transforming the Industry Landscape

- More Opportunities for Investors: From local to global, the options are limitless.

- Empowering Entrepreneurs: Worldwide funding for ideas that deserve to thrive.

- Scaling Crowdfunding Platforms: Break the local shackles; the world awaits.

The Future is Bright: $150 Billion and Beyond

Equity funding is projected to grow to unprecedented levels:

- Explosive Transaction Growth: Tens of billions of transactions, a new normal.

- Dacxi Coin’s Evolution: Integral to the process, its value and impact are set to soar.

The Societal Impact: Beyond Business

- Economic Growth: By fueling entrepreneurship, Dacxi Chain contributes to global economic vitality.

- Democratization of Finance: From Wall Street to Main Street, investing becomes an activity open to all.

A New Era Beckons

Dacxi Chain is more than a financial revolution; it’s a symbol of a new era that redefines global equity crowdfunding. It stands as a beacon of transformation, leading the world from exclusion to inclusion, from confusion to clarity. Whether you’re an investor, an entrepreneur, or simply a curious observer, the doors to the Dacxi Chain world are open, inviting you to join a movement shaping the future. The new era awaits, and the choice is yours.

A Deep Dive into Dacxi's Revolutionary Vision: Insights from Our Recent AMA with CEO Ian Lowe

The technological revolution is undeniably upon us, disrupting every conceivable sphere of human endeavour, with finance being no exception. In recent years, the finance world has witnessed a growing shift towards decentralisation, and spearheading this seismic change is Dacxi, an innovative, cutting-edge platform that’s committed to democratising the world of investment. Recently, Dacxi Chain hosted an AMA and I sat down with Ian Lowe, CEO, to delve into the heart of Dacxi’s ecosystem, the potential of its Dacxi Chain, the power of the Dacxi coin, and the vision behind its ongoing equity crowdfunding round.

Dacxi Chain: A Radical Shift Towards Decentralised Investment

The first topic of our detailed conversation centered around the disruptive potential of Dacxi Chain. Lowe passionately described it as a groundbreaking technology capable of reshaping the global investment paradigm. The Dacxi Chain’s fundamental purpose is to bridge the gap between growth companies seeking capital and retail investors looking for profitable opportunities. It achieves this by integrating various equity crowdfunding platforms into a decentralised network, thereby simplifying and democratising the investment process for all.

But what truly sets Dacxi Chain apart from traditional crowdfunding models? For starters, it dismisses the centralised framework, long seen as a hallmark of investment, in favor of a more inclusive, global approach. This shift towards decentralisation offers a plethora of benefits, including scalability, increased speed of transactions, and a quicker, more cost-effective route to market. Lowe was keen to emphasise that no competitors were currently offering anything similar, a testament to the unique proposition Dacxi Chain brings to the table.

Dacxi Coin: More Than Just a Transactional Currency

As the conversation moved towards Dacxi coin, Lowe discussed its integral role in the Dacxi ecosystem. He succinctly described it as a transactional currency, primarily used to facilitate efficient and low-cost investments on a global scale. However, he was quick to underscore that its utility extended far beyond this primary use case.

The Dacxi coin holds immense potential in a multitude of secondary use cases. It could potentially minimize transaction fees on the Dacxi blockchain, act as a facilitator for transactions on secondary markets, and even serve as a currency for investment purposes. The multifaceted utility of Dacxi coin epitomizes Dacxi’s comprehensive vision and its unwavering commitment to revolutionize the global finance landscape.

Equity Crowdfunding: A Testament to Dacxi’s Transparent Ethos

The equity crowdfunding round that Dacxi is currently spearheading served as another engaging topic during the AMA chat. Lowe explained that by choosing to raise capital via their network, Dacxi is essentially demonstrating the power and efficiency of their technology. This effort is also a shining example of Dacxi’s transparent ethos. Lowe revealed that they would be sharing critical information about the company, such as partner sign-ups, deals, and expansion strategies, through the equity crowdfunding offer document.

The democratic approach to fundraising and the exciting potential of Dacxi’s offering make this an intriguing opportunity for investors worldwide. Lowe further added that they weren’t just interested in raising capital; instead, they saw this as an opportunity to invite their community to become an active part of Dacxi’s growth journey.

Looking Ahead: The Future of Dacxi

As we delved into Dacxi’s future plans, Lowe shared that the company is keenly pursuing global expansion. He mentioned ongoing discussions with established platforms worldwide, hinting at a proactive approach to building strategic partnerships. This global vision certainly carries its share of challenges, but Lowe remains confident that their decentralised model provides the most efficient and scalable path to market.

The conversation also shed light on Dacxi’s commitment to regulatory compliance. Lowe was clear that Dacxi is dedicated to working within existing regulatory frameworks, which can vary significantly across regions. Navigating this complex web of global regulatory norms certainly adds a layer of complexity to Dacxi’s operations, but the company is undeterred, viewing it as an essential part of building a sustainable, long-term business. To listen to the full AMA conversation watch the video below.

Final Thoughts

Reflecting on our conversation, it’s evident that Dacxi is not just another player in the fintech space. With its ambitious plans, revolutionary technology, and a strong emphasis on transparency and community, it’s a company that’s rewriting the rules of global investment.

Under the strong leadership of Ian Lowe, Dacxi is demonstrating that it’s possible to combine innovation, inclusivity, and profitability in the often tumultuous world of finance. The potential of the Dacxi Chain, the multifaceted utility of the Dacxi coin, and the vision behind their equity crowdfunding round all converge to paint a picture of a bold, disruptive future for finance.

While the world watches in anticipation, one thing is for certain – Dacxi is not content to merely observe the future of investment. They’re shaping it, one transaction at a time. In a world that’s ripe for financial disruption, Dacxi offers a glimmer of what a truly democratic, decentralised global investment landscape might look like. It’s a vision that’s not just radical and bold, but one that could very well define the future of finance.

Pushing the Boundaries of Crowdfunding: The Crowdcube Story

In the dynamic and exciting world of startups, where dreams and innovation converge, there’s one story that continues to stand out from the crowd. And that’s the story of Crowdcube. Renowned as a trailblazer in the equity crowdfunding sector, Crowdcube has revolutionized the way startups and entrepreneurs approach fundraising. Its innovative founders carved out an extraordinary path – leaving a lasting impact on the crowdfunding space in their wake.

In this next installment of our “Crowdfunding Giants” series, we’re looking back on Crowdcube’s incredible journey to success – then looking to the future, as rising stars like Dacxi Chain continue to redefine the possibilities of crowdfunding.

The Genesis of Crowdcube: Reshaping the Investment Landscape

In the late 2000s, two forward-thinking pioneers – Darren Westlake and Luke Lang – shared one vision; to rebuild start-up investment from the ground up.

Their dream was to break down traditional fundraising barriers, so the world’s entrepreneurial potential could truly break free. To not only democratize investment, but to also empower everyday individuals to share in the companies’ growth journeys.

This dream led to the creation of a whole new concept; equity-based crowdfunding. This novel fundraising model would see individuals’ investments pooled, so entrepreneurs could connect with – and gain funding from – the public directly. All without having to rely on traditional methods, such as angel investors or banks.

This innovative and somewhat controversial idea faced considerable skepticism, and numerous regulatory challenges. Yet Westlake and Lang remained steadfast in their belief that, by connecting investors and entrepreneurs directly, their model had the power to democratize investment.

In 2011, Westlake and Lang launched Crowdcube; the world’s first equity crowdfunding platform.

Crowdcube’s unique model was heavily influenced by its two founders’ unique skillsets. A seasoned entrepreneur himself, Westlake’s deep understanding of fundraising challenges laid the groundwork for Crowdcube’s entrepreneur-centric ethos.

The second half of the equation, Lang’s marketing background offered profound insight into the power of community building, compelling narratives, and audience engagement – all of which proved instrumental in shaping Crowdcube’s crowdfunding approach.

Crowdcube soon evolved into so much more than a platform. It was a catalyst for change, a symbol of innovation, and a beacon of resilience.

Today, thanks to its founders’ grit, innovation, resilience, and vision, Crowdcube is seen as a disruptive and groundbreaking force in the crowdfunding sphere. Under Westlake and Lang’s leadership, Crowdcube continues to navigate – and shape – the rapidly changing startup landscape.

Walking the Walk: How Crowdcube Crowdfunded its Own Platform

In 2023, Crowdcube made a bold move; it used its own platform to crowdfund itself. In the ultimate embodiment of its disruptive ethos and innovative spirit, Crowdcube embarked on an ambitious crowdfunding campaign – reserving £2 million specifically for retail investors on a first-come, first-served basis.

The campaign wasn’t just successful; it was phenomenally triumphant. The Crowdcube community showed ‘overwhelming interest’ in this ground-breaking initiative, and it exceeded its fundraising goal in record time. – The campaign also saw a significant investment from global tech platform, Circle. This strategic alliance aimed to accelerate Crowdcube’s expansion into Europe, and help build a global marketplace for private company investments. A robust vote of confidence, Circle’s investment underscored crowdfunding’s potential to attract significant partners.

The resounding response reinforced Crowdcube’s effectiveness and credibility as a fundraising tool. It affirmed the trust that the community placed in Crowdcube’s vision, leadership, and strategic direction. It further ignited enthusiasm for Crowdcube’s equity crowdfunding model, and its potential to revolutionize the investment landscape.

Crowdcube’s own crowdfunding success marked a significant milestone in its journey. Establishing it not just as a fundraising platform, but as a shining example of the transformative power of equity crowdfunding.

Crowdfunding Success: Providing the Launchpad for Hundreds of Businesses

Over the years, Crowdcube has facilitated the growth of an array of businesses across incredibly diverse sectors. Crowdcube campaigns have collectively raised over £1 billion – elevating startups to new heights, reinvigorating established brands, and creating untold success stories.

One such story is the UK’s pioneering electric car-sharing service, E-Car Club, which gained its initial funding from Crowdcube before being acquired by Europcar. Camden Town Brewery also used Crowdcube to raise funds for its brewery expansion, and later merged with beer titan AB InBev. Parcel2Go was another triumph. After raising significant funding through Crowdcube, the leading parcel delivery comparison site has gone from strength to strength.

Crowdcube’s influence extends beyond high-profile success stories. The platform has driven the growth of hundreds of smaller businesses, all benefiting from Crowdcube’s unfettered access to capital and community engagement

Whether it’s tech startups, breweries, or delivery services, Crowdcube’s wide-ranging success stories underscore the potential of community-backed funding to transform business ideas into reality.

Guide to Success: Lessons for Future Entrepreneurs

For entrepreneurs and start-ups traversing the complex crowdfunding landscape, Crowdcube serves as a guiding light. From community building and transparent practices, to engaging storytelling and the pivotal role of founders – here are a few valuable lessons to take from this remarkable company’s story.

Strong Community Building: Crowdcube’s supportive and active community is central to its success. Crowdcube’s backers bolstered not only various businesses but also the company’s own campaigns, highlighting the significance of an active and engaged community.

Maintaining Transparency: Crowdcube’s commitment to clear and honest communication fostered an environment of trust. When potential investors are asked to back early-stage businesses, this trust is particularly pivotal.

Compelling Value Proposition: Crowdcube’s mission to democratize investment resonated with many who felt traditional investment opportunities were well out of reach. This highlights the importance of a clear and compelling value proposition.

Founders’ Narrative: The story of Crowdcube’s founders, Darren Westlake and Luke Lang, played a vital role in earning investor trust and enthusiasm. Their personal narratives, skills, and visions contributed significantly to Crowdcube’s success.

Turning a Profit: Bouncing Back from Challenges

After bouncing back from 2020 losses, Crowdcube turned a profit for the first time in 2021. This success was largely driven by a surge in crowdfunding campaigns – particularly those by larger, later-stage companies.

Post-Brexit, Crowdcube benefited from favourable regulations – which saw UK-based startups able to raise up to €16 million in total through crowdfunding, without the expensive prospectus process required for IPOs.

Moving forward, Crowdcube plans to increase profits through its shares marketplace, Cubex, and by offering “community IPOs” to retail investors. This innovative approach firmly positions Crowdcube as a challenger to traditional players in the industry.

Looking Forward: The Evolving Landscape of Equity Crowdfunding

As Crowdcube continues to carve out its niche, equity crowdfunding is undergoing significant transformation. While the platform is well-poised to navigate and even lead these changes, it must contend with emerging competitors eager to disrupt the market.

One such competitor is Dacxi Chain. Leveraging blockchain technology, Dacxi Chain aims to create a global crowdfunding network – pushing the boundaries of crowdfunding and challenging the industry status quo.

In an ever-evolving industry, competition and innovation go hand-in-hand. This exhilarating combination will likely drive platforms like Crowdcube and Dacxi Chain to continuously redefine the rules. Whatever shape crowdfunding takes in the future, Crowdcube is sure to continue to play an influential role. However, as new players like Dacxi Chain enter the scene, it will no doubt be fascinating to witness their impact on the industry.

Conclusion: Crowdcube, Dacxi Chain, and the Evolution of Crowdfunding

Crowdcube’s journey is a testament to the transformative power of innovation, entrepreneurship, and vision. In its mission to democratize investment, it has successfully challenged traditional fundraising models – positioning itself as a key catalyst in the equity crowdfunding revolution.

Looking ahead, platforms like Dacxi Chain are poised to usher in the next wave of crowdfunding. A wave that promises unprecedented transparency, security, and globalization.

With Crowdcube setting the stage for new players like Dacxi Chain, the future of crowdfunding appears ripe with possibilities. As the crowdfunding pioneers continue to break barriers, redefine the industry, and influence the next generation of disruptors, we look forward to the thrilling new era ahead.

Investors and entrepreneurs should remain aware of the inherent risks associated with all forms of investment. Both Crowdcube and Dacxi Chain encourage due diligence, reminding potential investors that investments can fluctuate in value – necessitating informed decisions.

References

Westlake, D., & Lang, L. (2023). Crowdcube: The First Decade. Crowdcube.

Crowdcube (2023). Crowdcube Raises £2m in Record Time Through Its Own Platform. Crowdcube Press Release.

Smith, M. (2023). Crowdcube Passes £1 Billion in Fundraising. TechCrunch.

Stay tuned for our next installment in the “Crowdfunding Giants” series as we delve into the stories of other key players shaping the crowdfunding industry. Remember, today’s giants were once startups themselves, disrupting the status quo and setting the stage for change.

Dacxi Chain – Disrupting the Global Equity Crowdfunding Space, One Block at a Time

Last night, Ian Lowe, an industry pioneer, CEO and key figure behind the Dacxi Chain project, hosted an informative webinar. With his clear explanations and notable passion, Lowe highlighted the promising potential of the Dacxi Chain. For those seeking a better understanding of this innovative platform, the webinar is a great resource. Watch the Webinar Here.

A Vision Materialized

“Change is the only constant.” This proverb is no more relevant than in today’s rapidly evolving tech landscape, where blockchain technology and crowdfunding fuse to bring us the world’s first global equity crowdfunding network – the Dacxi Chain.

After six relentless years of innovation, dedication, and an unwavering belief in democratizing investments, the Dacxi Chain has moved from being a grand idea to a tangible reality. But let’s be clear: this is just the beginning of an exciting journey that’s poised to reshape the world of crowdfunding and revolutionize global investment.

A Bold Move

In a monumental event that epitomizes the phrase ‘walk the talk’, Dacxi Chain announced its first-ever deal – a deal that sees the platform crowdfunding itself. This bold move isn’t just a statement about its confidence in the disruptive power of its technology, but also a demonstration of its commitment to reshaping the landscape of global equity crowdfunding.

Why Dacxi Chain Matters

The real question here is not what Dacxi Chain is doing, but why it matters. The Dacxi Chain isn’t simply a business seeking investment. It’s a vehicle that promises to redefine investment for millions across the globe. It’s about the democratisation of crowdfunding, about giving power back to the people, and enabling countless innovative ideas to take flight.

A New Era of Investment

Imagine having access to a global pool of investment opportunities, secured by the unparalleled transparency and security of blockchain technology. Imagine the liquidity and ease of investment operations, all made possible by Dacxi Chain’s unique model. Now, isn’t that something worth betting on?

Tangible Benefits and Concrete Deliverables

But the Dacxi Chain isn’t just about grand ambitions and blue-sky visions. It’s an enterprise that’s rooted in tangible benefits and concrete deliverables. And it is these deliverables that have elicited the strongest possible validation from equity crowdfunding platforms, all of whom are privy to Dacxi Chain’s unique vision and innovative technology.

Bridging the Gap

No platform has ever bridged the gap between investors and entrepreneurs quite like the Dacxi Chain. For the first time, this innovative platform is giving the power back to the people by allowing investors to directly support and fund companies they believe in, rather than leaving these important decisions to intermediaries. This unique aspect of the Dacxi Chain isn’t just disruptive; it’s revolutionary.

Just the Beginning

And yet, this is just the first chapter of the Dacxi Chain story. The team is not resting on its laurels. Instead, they’re excitedly charting the course for the next phase of their journey, fueled by the belief that the future holds more significant milestones and unparalleled successes.

Explore Dacxi Chain in Action

To gain a richer understanding of Dacxi Chain’s groundbreaking approach and its implications for global equity crowdfunding, make sure to watch the informative webinar included below. It provides a captivating deep-dive into the world of Dacxi Chain, and a chance to see the technology in action, highlighting its potential to revolutionize the investment landscape.

We invite you to watch this comprehensive webinar to better understand the unique value proposition of Dacxi Chain and see firsthand how it’s poised to transform global equity crowdfunding.

Being Part of a Movement

In a world where the landscape of investing is rapidly changing, Dacxi Chain offers an exciting prospect. It presents a platform that is not just about fundraising or supporting companies; it is about being part of a broader movement to democratize global equity crowdfunding. And with the first-ever deal through the Dacxi Chain network – the Dacxi Chain itself – the platform has proven its commitment to this cause.

An Invitation to Join

This isn’t just an invitation to invest. It’s an invitation to join a movement that is set to redefine tomorrow. It’s a chance to be part of an innovative journey that promises not just returns, but also the satisfaction of being part of a grand vision.

The Journey Begins

Dacxi Chain has embarked on this journey, and it’s a journey that promises to be full of discovery, growth, and possibly, revolutionary success. And the platform’s commitment to transparency, security, and innovation, encapsulated in their upcoming AMA sessions and regular check-ins, are testament to their unwavering belief in the power of their vision.

The Future of Crowdfunding

So, stay tuned, because there’s more to come from this groundbreaking platform. With the Dacxi Chain, the future of crowdfunding isn’t just a possibility; it’s a reality that’s already unfolding. And it’s a reality that invites you, the investors, to be part of this innovative journey.

Ready for the Revolution?

This is Dacxi Chain. The future of crowdfunding starts here. If the journey to redefine the world of crowdfunding and investing excites you, then the Dacxi Chain is worth your time and attention. As we embark on this pioneering journey, we look forward to taking you along, sharing every milestone, every success, and every groundbreaking innovation. The world of crowdfunding will never be the same again, and it’s all thanks to Dacxi Chain. Are you ready for the revolution?

(Note: The content of this article is intended to convey general information only. This article does not provide investment, legal, tax, etc. advice. You should not treat any information in this article as a call to make any particular decision regarding cryptocurrency usage, legal matters, investments, taxes, cryptocurrency mining, exchange usage, wallet usage, initial coin offerings (ICO), etc. We strongly suggest seeking advice from your own financial, investment, tax, or legal adviser. Neither the author nor Dacxi Chain can be held responsible for any decision you make to invest in cryptocurrencies or to launch ICOs, based on the information in this article.)

Dacxi Chain: Pioneering the Future of Equity Crowdfunding - An In-depth Look at the Roadmap

In the bustling financial technology industry, where innovation is the linchpin of success, a fresh name has caught the attention of insiders and laymen alike. The Dacxi Chain, an ambitious initiative that envisages a seamlessly interconnected network of global equity crowdfunding platforms, is steadily coming to the fore. A recent episode of their podcast series, “Unleashed with the Dacxi Chain,” peeled back the layers of their audacious mission, setting the stage for a detailed exploration of Dacxi Chain’s strategic roadmap and its forward-looking vision for reshaping the crowdfunding landscape.

A Radical Redesign of Equity Crowdfunding

In the third instalment of the Dacxi Chain podcast, CEO Ian Lowe sat down with host Andy Pickering to dissect the ways in which Dacxi Chain could revolutionize equity crowdfunding. Equity crowdfunding, according to Lowe, represents a mere fraction of the funds invested in growth-oriented firms, accounting for less than 1% of capital. Lowe highlighted this underutilization as a prodigious opportunity waiting to be tapped, one that Dacxi Chain has firmly set in its sights.

The Dacxi Chain’s approach is rooted in the concept of connectivity. It seeks to build bridges between different crowdfunding platforms, helping them tap into each other’s crowds and greatly expand their outreach. Moreover, it aims to speed up the process of raising capital for growing companies by leveraging a larger, more diversified pool of investors.

What sets Dacxi Chain apart, Lowe elucidates, is its commitment to a cooperative rather than competitive model. In contrast to seeking to oust existing platforms, Dacxi Chain seeks to empower them by providing a decentralized framework where each can thrive in its own right.

Charting the Path Forward: An Inside Look at the Dacxi Chain Roadmap

Turning to the roadmap, Lowe reveals the strategic direction of Dacxi Chain. Following the initial launch and integration with foundational partners, the Dacxi Chain will focus on closing a successful first deal. The realization of this deal will act as a catalyst, refocusing Dacxi Chain’s efforts towards two primary objectives: Spreading the word about the platform and expanding its network through new partnerships.

Lowe is steadfast in his belief that these two factors will set off a network effect that will fast-track the equity crowdfunding industry’s growth. He envisions the Dacxi Chain becoming a powerful hub that fuels the industry’s growth by drawing in an ever-increasing number of platforms and offering a growing array of investment opportunities.

But the expansion of the network is just one part of the strategy. Dacxi Chain is also gearing up to enhance its platform with a host of new features specifically designed to benefit both issuers and investors.

For issuers – the companies aiming to raise capital – Dacxi Chain is striving to provide actionable insights on deal flow and a slew of other metrics gleaned from the entire network. These insights, Lowe suggests, can guide companies in crafting a compelling narrative that resonates with potential investors, thereby increasing the chances of successful capital raising.

On the other hand, investors stand to gain from the suite of tools that Dacxi Chain is planning to integrate into its platform. These tools will help investors navigate the world of equity crowdfunding, make informed decisions about the right investment opportunities, and map their path to potential future earnings.

The Changing Tide of Equity Crowdfunding: Shifting Power Back to the Individual Investor

With the rise of Dacxi Chain, Lowe sees a major shift in the dynamics of equity crowdfunding on the horizon. He contends that Dacxi Chain’s innovative network model will democratize investing, empowering individual investors by giving them more access to a broader spectrum of high-quality investment opportunities than ever before.

At its core, the Dacxi Chain mission is to decentralize power within the equity crowdfunding sector, transferring influence from the few to the many. By enhancing the level of transparency and choice available to investors, Dacxi Chain aims to upend traditional power structures and cultivate an investment landscape where the individual investor is king.

It’s a lofty vision, but one that is grounded in an intimate understanding of the pain points currently hindering the equity crowdfunding sector. Too often, the investor landscape is dominated by a small coterie of venture capitalists and angel investors who hold the keys to high-potential start-ups and scale-ups. Dacxi Chain aims to level this playing field, using technology to give individual investors unprecedented access to growth-oriented firms.

Advancing the Blockchain Frontier: Leveraging Decentralization to Benefit All Parties

Lowe’s vision for Dacxi Chain does not stop with equity crowdfunding. He sees the blockchain technology underpinning Dacxi Chain as a major catalyst for change within the broader financial industry.

Through blockchain technology, Dacxi Chain hopes to disrupt the status quo by making transactions faster, cheaper, and more secure. It envisions a world where all parties involved – issuers, investors, and crowdfunding platforms – can benefit from the democratization and decentralization of the financial sector.

By harnessing the power of blockchain, Dacxi Chain can create an open, transparent and secure system where all transactions are recorded on an immutable ledger. This increases trust and accountability, reduces the chance of fraud, and makes the entire process more efficient.

The Next Steps: Continued Growth and Expansion

As Dacxi Chain moves forward, its roadmap is crystal clear. After successfully implementing its initial integration and fostering partnerships with key players in the crowdfunding space, Dacxi Chain is now ready to expand.

This next phase involves onboarding more equity crowdfunding platforms onto the Dacxi Chain, expanding its reach globally. With each new addition, the network grows stronger, providing more opportunities for both issuers and investors.

Moreover, Dacxi Chain is not just looking at geographical expansion but is also planning to diversify the sectors and industries that it caters to. From tech startups and green energy to health care and education, Dacxi Chain aims to become the go-to platform for any business seeking crowdfunding.

If you’d like to get a more in-depth understanding of Dacxi Chain’s strategy and future plans, consider tuning into their podcast. There, you can listen to Ian Lowe, CEO of Dacxi Chain, share more about this game-changing platform. Watch the full podcast here.

.

A Future-Proof Vision: Driving Industry-Wide Change

In the final segment of the podcast, Lowe paints a compelling picture of what the future might look like for Dacxi Chain and the equity crowdfunding industry at large. He envisions a future where Dacxi Chain acts as a central hub, connecting crowdfunding platforms, issuers, and investors worldwide.

He imagines a world where start-ups and growth-oriented firms, irrespective of their geographical location, can access a global pool of potential investors. Conversely, he sees a world where investors, irrespective of their wealth or expertise, can peruse a wide range of investment opportunities spread across different sectors and regions.

By breaking down the barriers that have traditionally hampered the equity crowdfunding sector, Dacxi Chain is aiming to create a world where capital is more freely available, where power is more evenly distributed, and where opportunities are open to all.

In conclusion, the Dacxi Chain roadmap points towards an exciting future for the equity crowdfunding industry. With its innovative approach and ambitious goals, Dacxi Chain is poised to pioneer a new era of crowdfunding, one that is driven by interconnectivity, transparency, and democratization. This journey will not be without challenges, but as Lowe remarked in the podcast, “It’s a journey that we are eager and ready to embark on.”

Dacxi Chain Launch: Roadmap to the Future of Crowdfunding - Episode 3/3

Dacxi Chain Launch: Roadmap to the Future of Crowdfunding - Episode 3/3

This is the third of three special episodes of “Unleashed with the Dacxi Chain,” to celebrate the launch of phase one of the Dacxi Chain’s global equity crowd-funding solution.

In this episode, host Andy Pickering and Dacxi Chain CEO Ian Lowe discuss how the Dacxi Chain will enable different equity crowdfunding platforms to connect and tap into each other’s crowds. This will expand access to investment opportunities for individual investors and provide growth companies with faster and potentially cheaper capital.

The roadmap includes signing more partners, spreading awareness about the platform, and developing new product features that benefit both issuers and investors. The first deal is set to be announced soon, which is expected to bring exponential growth in equity crowdfunding over the next few years through a network effect. Ian encourages people interested in investing in private high-growth companies to take a closer look at what investment opportunities are available on their local crowdfunding platforms and diversify their portfolio while taking a medium-to-long-term view.

Music courtesy of BlackIrisFilms.com

Share this article

Andy Pickering – Host

Welcome to Unleashed with the Dacxi Chain, a Dacxi podcast where we learn all about the Dacxi Chain and the incredible opportunities it unlocks. This is episode three in our special three-part series, acknowledging and celebrating the launch of the very first stage of the Dacxi Chain. I am, of course, joined again by Dacxi Chain CEO Mr. Ian Lowe. In this episode, we’re going to dig deep into the Dacxi Chain roadmap and explore again the vision of the Dacxi Chain and the future of equity crowdfunding. Welcome back, Ian.

Ian Lowe – Guest

Thanks, Andy. Good to be talking to you.

Andy Pickering – Host

So as I say, today we’re going to talk about the roadmap of the Dacxi Chain. But before we do that, just recap again for us, how is the innovative approach of Dacxi Chain about to shape the future of equity crowdfunding?

Ian Lowe – Guest

Yeah, I’d be happy to. So look, in a nutshell, equity crowdfunding today represents less than 1% of the capital that finds its way into growth companies. We think that’s a huge missed opportunity. And realizing the opportunity for equity crowdfunding is about offering it a future built around scale and enabling that scale so that different platforms essentially can tap into each other’s crowds. And equally, those platforms can enrich their catalog and investment opportunities so that they can build, attract, and build a larger crowd on their own platform. So the Dacxi Chain technology is a set of tools, a set of pipes if you like, that allows those licensed, established, reputable, existing crowdfunding platforms to connect directly with each other.

And we do that under a decentralized model where we’re not a competing destination for investors to come, nor are we competing in any way, shape, or form with the partners using the network in trying to find growth companies looking for growth capital. And so that is the proposition. That Dacxi Chain proposition, we think with a few cycles of growth behind it as we sign more platforms, redraws the lines of the innovation economy by offering equity crowdfunding a much bigger seat at the table and more specifically, individual investors, more and more access to great investment opportunities and for companies looking for growth capital. Access to more capital, faster capital, and over time, potentially even cheaper capital.

Andy Pickering – Host

Yes, indeed. All right, I said we’d talk about the product roadmap, Ian, so how should we frame this? Tell us what you can about the Dacxi Chain’s strategic blueprint for the future of equity crowdfunding and what that looks like in terms of where we are on the roadmap at the moment and of course where we hope to get to in the future. Lay it out.

Ian Lowe – Guest

So look, the core proposition is about saying we’ve gone out and researched the market, we’ve built some requirements, we’ve gone and developed a launch platform and we’ve signed and integrated some foundation partners and then the first deal will flow through those pipes. We expect that first deal to be successful and at the end of that first deal we’re really going to refocus on two core streams of work. The first is spreading the good news so we can go out and share the details of what we’ve built, how it works, the benefits associated with that, and all of the insights from that first deal with other partners and starting to build the network.

Because it is that network effect and the compound growth in deal flow that we get from that network effect that will ultimately realize the vision of providing real scale through this technology to the equity crowdfunding industry. So that stream of work really kicks off in earnest at that point. In combination with that, there’s a whole range of new product features that we want to bring into the technology itself. And so these are features that are focused on providing additional value to the two primary beneficiaries, being the issuer that is the company raising capital, and the investor that’s actually putting the money into that business in exchange for equity. And so there’s a range of ways in which we think we can bring incremental value to the table of both of those parties.

The first as it relates to the issuer, is to realize that ultimately their interests are represented by the platform that they partner with to help them raise the capital. And so for those platforms, we are looking to bring insights around deal flow and a whole bunch of different metrics that we can look at across the entire network, not just within individual platforms themselves, and help them learn from those insights as to how they can more successfully attract companies in the first place to look at equity crowdfunding as their chosen source of capital for growth, and equally, how they can help those growth companies market their business in order to close a successful capital raising round through the crowd. So they’re the benefits on the issuer side of the transaction.

But then on the investor side, as we start to enrich the catalog of investment opportunities for those investors, we believe there are some really great tools that we can bring into the experience they’re having with each of those local crowdfunding platforms.

So remember, those investors do not come to Dacxi Chain, they access these opportunities through their local licensed crowdfunding platform, the platform that they might already be using for example. But there are some tools that we can offer those crowdfunding partners of ours which in turn they can expose to individual investors on their own platforms, which we think will help build the confidence of those investors around what is the right opportunity for them to say how do I best understand that opportunity? And what does the path to harvest, including potential time frames, start to look like?

And of course, when we talk about harvests being a blockchain enabled infrastructure, it means that we can offer individual investors that path to a harvest event, the time frame of which is their own choosing. Because through a tokenized shareholding, they can access secondary markets and they can liquidate some or all of those shares in the time frame that they choose.

Andy Pickering – Host

Yes, indeed. Okay. Well, thank you, Ian. As we come to the end of this special three-part episode series, we’ve had the Dacxi launch event, which is on YouTube, so we do suggest that you watch that if you have not already. If you have, you’re probably already very excited for what comes next. But just before we tease people with some anticipation in terms of what comes next, Ian, do you have any final thoughts or advice for people that are interested in getting involved and understanding where the trajectory of equity crowdfunding is going? Where do you think this is all heading, Ian?

Ian Lowe – Guest

Look, a number of the people that are listening to this discussion would already be participating in equity crowdfunding or have at some point in the past, but there’s a bunch of people that also won’t have. And so what we would say to them is, look, equity crowdfunding is growing with or without Dacxi Chain, okay? It’s going through a cycle of growth. 2023 is a particularly challenging market for securing capital for any company, public or private. So 2023 we might see a flattening of the previous years, but beyond that, we can already start to see signs that the growth trajectory will continue as it has over the last couple of years. So equity crowdfunding is growing.

But really what we’re talking about here is exponential growth over the next three or four market cycles, let’s call it, over the next three to five years, where we give equity crowdfunding, through this network effect, a seat at the table well beyond the less than 1% that it currently represents of the innovation economy. So what that really does is it shifts the balance of power away from the few that control so much of that growth capital in the form of venture capitalists and the like. And it swings that pendulum back to empower or democratize investing for the individual investor and the power and the strength of the crowd. We think that’s enormously important in terms of that imbalance that we see today, and we see a significant number of benefits.

So to answer your question, I would encourage people to take a closer look and register on a local crowdfunding platform. We’ll be talking about who our partners are and how they can register on those platforms in great detail. So we’ll be helping people get involved, but we would encourage people to get involved, register, take a closer look, start to understand what investment opportunities actually are available to you. It’s a lot broader, it’s a lot more diverse, and a lot more exciting than a lot of people realize. And to find the right opportunity is the entry point. Find that right opportunity that you either understand or resonates for some reason with you as the entry point. And as always, with any kind of wealth building, take a medium to long-term view. That’s absolutely critical. So diversify and take that medium to long-term view.

And the first step really needs to be something that you understand or appeals to you in some particular way. That’s the ideal way to start the journey as it relates to investing in high-growth private companies.

Andy Pickering – Host

Yeah. Great thoughts, Ian. And look, I very much agree. I think it’s such a great point. If you can find something that is personally interesting to you and something you believe in, it just makes your conviction in whatever investment that might be much stronger. And it means that you can have the conviction to have that long-term view. And if you have a belief or a passion or an interest in whatever that particular sector or field may be, it just makes the investing ride that much more fulfilling. Great words, Ian. Thank you so much. To finish off this three-part series, anything you can tease us with in terms of that first announcement, we know it’s coming soon.

Ian Lowe – Guest

Oh, look, it’s coming very soon. It’s only a matter of days and weeks until all of the detail will be revealed. But I also just want people to know that we’re going to step them through it, so we’re going to make it very clear how they can get involved if that’s something that they’d like to do. We’ll be sharing more detail about the specifics of that deal, and the time frame in which we expect that deal will open and then close, so all of that will be shared. There’ll be quite a bit of detail that will be forthcoming. So we’re obviously really excited about being able to do that.

Andy Pickering – Host

Absolutely. You heard it here first, folks. So all you can do is keep it locked to the various Dacxi Chain communication channels. That brings us to the end of our special three-part series, acknowledging the launch of the first phase of the Dacxi Chain. Thanks for being here, Ian, and I’m sure we’ll see you very soon. Cheers.

Ian Lowe – Guest

Thanks, Andy. Good to talk to you.

Unveiling the Future: Dacxi Chain Global Equity Crowdfunding Network Launch Webinar

Unveiling the Future: Dacxi Chain Global Equity Crowdfunding Network Launch Webinar

The Groundbreaking Launch of Dacxi Chain: A New Era of Equity Crowdfunding

The Dawn of Dacxi Chain

As the virtual curtains were drawn back and the innovative mechanism hummed to life, Ian Lowe, CEO of Dacxi, unveiled the highly-anticipated Dacxi Chain platform during an exciting webinar. This groundbreaking platform promises to revolutionize equity crowdfunding, harnessing technology to provide unprecedented access and opportunities for investors and issuers alike. This launch signifies more than the release of a new platform; it heralds a new era in equity crowdfunding, one that bridges the gap between investors and issuers like never before.

To view the full webinar and experience the thrilling launch of the Dacxi Chain for yourself, you can watch it here:

The Mechanics of Dacxi Chain: An Intuitive Interface for Global Reach

For those who couldn’t tune in, let’s dive into the details. The Dacxi Chain isn’t just another platform; it’s a global equity crowdfunding network that binds together crowdfunding companies across the world. Its primary aim is to create unprecedented scale and global reach, thus providing immense opportunities to businesses and investors alike.

The interface is designed to be intuitive and seamless, catering to the needs of its global user base. Users can upload files, create deals, and save them in a list called “My Deals”. This provides an easy overview of the user’s investment portfolio. Every detail of a deal can be reviewed, edited, and finalised at the user’s convenience, ensuring that the platform is not just technologically advanced but also user-friendly. Through Dacxi Chain, global reach and connectivity are just a few clicks away.

Regulatory Compliance: Audit Trails

An essential aspect of any platform dealing with financial transactions is regulatory compliance. With Dacxi Chain, users get access to a full audit trail. This trail captures all activity within a deal, including creation, internal approval, and network sharing. The platform also includes date and timestamps for all actions, a feature that is invaluable for maintaining regulatory compliance and audit readiness.

Network Sharing: A Single Click

One of the highlights of Dacxi Chain is its ease of deal sharing. Upon deal finalization, the user can share the deal with the entire Dacxi Chain network with a single click. These deals are then made visible across the global Dacxi Chain network, ensuring a uniform and consistent representation for all users. This effortless shareability extends the reach of each deal, increasing the opportunities for both investors and issuers.

The Power of Partnership: Selecting the Right Partners

But it’s not just about the technology; it’s about partnerships. Ian Lowe emphasizes the importance of handpicking the right equity crowdfunding partners, considering factors like business profile, reputation, and innovative prowess. This meticulous process of partner selection ensures the formation of partnerships that bring high-quality, fruitful collaborations to the Dacxi Chain platform.

Introducing Foundation Partners: Equitise and Snowball Effect

The result of this painstaking process? Foundation partners secured in Australia and New Zealand, with discussions well underway in the UK.

The first of these partners, Equitise, an Australian-based equity crowdfunding platform, has a broad range of retail and professional investors. The second partner, Snowball Effect, holds the title as the number one equity crowdfunding platform in New Zealand. These partners not only bring extensive market experience but also a large and growing investor base, solidifying their leading position in the market.

Announcing the First Deal: A Significant Milestone

Now, let’s delve into some exciting news that Ian Lowe unveiled. The first deal funded via Dacxi Chain is set to be announced on Tuesday, July 18. This momentous event marks a significant milestone in Dacxi Chain’s journey, setting the stage for a future filled with exciting possibilities and opportunities.

The Road Ahead: Gratitude and Anticipation

In conclusion, this swift and comprehensive walkthrough of the Dacxi Chain platform offered a glimpse into the future of equity crowdfunding. As we approach the announcement of the first deal, we anticipate a surge of interest and excitement from the investment community.

Ian Lowe rounded off the webinar with heartfelt thanks for the patience and support shown by all participants, highlighting that the launch was only possible due to the backing and belief of the Dacxi community.

Embracing the Future: Forging Ahead with Dacxi Chain

As Dacxi Chain forges ahead, this launch event serves as a firm reminder of the platform’s mission – to create a user-friendly, efficient, and effective way of connecting investors with businesses. It’s an exciting time for equity crowdfunding, with Dacxi Chain taking the lead in this innovative sector.

A Call to Action: The Invitation

As we prepare to unveil the first deal on July 18, we invite you to join us in this thrilling journey. The specifics will be shared during the announcement, and you’re welcome to participate and take part in this groundbreaking deal. The launch of Dacxi Chain is just the beginning of a future filled with promise and progress.

A Grateful Farewell: Closing the Webinar

As the webinar wrapped up, Ian Lowe expressed his profound gratitude to the attendees and the wider Dacxi community for their unwavering support and patience. It’s clear that Dacxi Chain is more than just a platform; it’s a community of individuals sharing a common vision of innovative equity crowdfunding. With the successful launch of Dacxi Chain, this vision has moved a step closer to becoming a reality.

In the face of this monumental achievement, all there is left to say is a big thank you for the ongoing support. Stay tuned for more exciting updates from Dacxi Chain and here’s to a bright and prosperous future in equity crowdfunding. That’s it for now. Until next time, thank you and goodbye.

Dacxi Chain Launch: A Network Effect Driven Paradigm Shift - Episode 2/3

Dacxi Chain Launch: A Network Effect Driven Paradigm Shift - Episode 2/3

This is the second of three special episodes of “Unleashed with the Dacxi Chain,” to celebrate the launch of phase one of the Dacxi Chain’s global equity crowd-funding solution.

In this episode, host Andy Pickering and Dacxi Chain CEO Ian Lowe discuss the power of the decentralized crowdfunding model and how it can enable equity crowdfunding platforms to connect with each other, share investment opportunities, and provide a richer catalog of options for investors. They emphasize that scaling equity crowdfunding will democratize investing in private companies for everyday investors while also giving high-growth businesses access to much-needed capital. The network effect is expected to drive participation and supercharge innovation globally. This paradigm shift in equity crowdfunding is set to redefine what’s possible for both investors and growth companies alike.

Music courtesy of BlackIrisFilms.com

Share this article

Andy Pickering – Host

Hey folks, welcome to episode two in our three-part special series of podcasts that celebrate the launch of the Dacxi Chain. In this episode, we’re going to talk more about the power of the Dacxi Chain, and what the network effect is that is going to help drive the growth of the Dacxi Chain network all around the world. We’ll understand some of Dacxi Chain’s advantages that come from its decentralized crowdfunding model. To learn about all of this, we are joined again by Dacxi Chain CEO Ian Lowe. Hello again, Ian.

Ian Lowe – Guest

Hi, Andy, glad to be here.

Andy Pickering – Host

Let’s dive right into it. I mentioned the decentralized model of the Dacxi Chain, Ian, so can you explain what that means, and what are the advantages that this decentralized model brings to the Dacxi Chain?

Ian Lowe – Guest

Thanks, Andy. So to set up the answer to your question, let me just explain briefly what Dacxi Chain is. So, Dacxi Chain is a platform as a service, essentially an underlying set of pipes and capabilities that allow equity crowdfunding platforms anywhere in the world, as long as they’re licensed, to connect to each other. And the reason they would do that is so that for an opportunity on one platform where that would normally only be invested in by their own local crowd on the same platform, that investment opportunity can be shared by that platform with a vast number of other platforms, all of whom have crowds of investors looking for great investment opportunities.

Okay, so it’s essentially a network model whereby any existing, established, credible, and licensed equity crowdfunding platform can get access to the network through a set of APIs that we provide. And through those APIs, they can connect with other platforms and essentially do two things: share deals that they’re offering to investors to a significantly larger pool of individual investors rather than just their own crowd. And secondly, they can offer the investors on their own platform a much larger catalog of investment opportunities that have started or have originated from other platforms in the network. So this addresses this whole chicken and egg constraint, which is about getting scale into equity crowdfunding by scaling not just the pool of investors through this Dacxi Chain network, but also the catalog of investment opportunities. And of course, the richer the catalog, the more attractive it is to investors.

So that network effect that you’ve referenced, where we get this compound growth through signing more platforms into Dacxi Chain, connecting them through our APIs, we grow the pool of investors, we grow the catalog of investment opportunities. Really, that compound growth, we believe will reimagine the scale of what’s possible for equity crowdfunding with some really clear benefits that touch the three principal beneficiaries, which are the investor looking to invest, the company that’s actually raising the capital so they can grow, and the platform that sits in the middle to connect those two groups together.

Andy Pickering – Host

Thanks, Ian. So this network effect that we’re talking about, I think you and I have talked about this before on previous podcasts, Ian. It’s a famous law, it’s called Metcalfe’s law, which very simply says that the financial value or impact of a network, a communications network, an electronic network, a blockchain network, the value of that network is proportional to the square of the number of connected users on the network. This is really just a fancy way of saying the larger the network, the more potential value. I’m sure that can make sense to people. So you’ve talked about going from local to international and being able to unlock the scale and potential of the Dacxi Chain opportunity. So, again, just in simple terms, explain how that works in terms of the decentralized network model?

Ian Lowe – Guest

Absolutely. So one of the things you’ve already referenced is that we are operating under what we call a decentralized network model. So let me explain what that means because it’s quite significant. So essentially to provide this network opportunity for independent platforms to plug into, to access scale on both supply and demand, there are two basic ways we can do it. There are actually three or four, but let’s just stick with two for now. One is a centralized model. One is a decentralized model. So I’ll explain what the decentralized model is by starting with an explanation on the centralized model. So a centralized model is where somebody comes in and says equity crowdfunding lacks scale. That’s a big constraint. That constraint is felt by everybody. Investors on one side, growth companies on the other.

Let’s solve that problem by creating a network and let’s make that network a centralized network. And what that means is that you’ve got one central party that controls that network. You’ve got one central party that is essentially aggregating the investors and aggregating the deals. They probably need to become a licensed crowdfunding platform themselves. They would need to do that in every market of operation. That would cast doubt over the ownership of the crowd for each of those platforms. It would cast doubt over the control and ownership of the deals for each of those platforms. And a centralized model would essentially create unhealthy competition between the network operator under that centralized model and the constituent partners that are plugged into that network, whereby the centralized player is saying, come to me to see the deals, come to me to invest.

And they are actively marketing a different destination to the destinations that already exist in the forms of the participating platforms. So a centralized model, just like bookings.com or expedia.com and all of these different industries where we’ve got a centralized model, if not immediately, shortly after that, is actually in direct opposition of the partners that create that catalog and aggregate those investors.

So if we look at a centralized model, we think that’s deeply flawed. Equally, I think over the next ten years, players will emerge who are already in equity crowdfunding, who will pursue a centralized model. And they’ll do it by trying to expand into lots of different countries, acquire and operate lots of different crowdfunding licenses, acquire and look to build lots of different standalone crowds, and then start to find ways to connect those crowds.

But in the end, it will still be a centralized model.

The decentralized model is a model that says we do not want to compete, the network should never compete with the partners that create the network. In fact, far from that, the decentralized model says, at its very core, our job is to make all of our partners spectacularly successful, because if they are successful, we are successful. So this very tight alignment of interest is what we achieve under the decentralized model. And the way we do that is the following. When a deal is exposed on a platform in the network, and it’s therefore, by definition, exposed to that platform’s own crowd, by releasing that deal into the Dacxi Chain network, that deal is now surfaced inside the platforms of all the other participating equity crowdfunding players.

So essentially what that means is that if I sit in another investor pool inside another platform that’s connected to the network, then I can see the investment opportunities that originate from other destinations, from other platforms in the network. I can see it inside my local platform. So what we’re essentially doing is we’re building the connective tissue between all of these platforms that allows them to share deals with each other. And then when investors on their local platform participate by investing in a deal that they didn’t own from the very beginning, those investors can participate in a much richer catalog of investment opportunities. But we don’t aggregate that in a centralized model. We actually distribute all of those deals into the platforms that people are already using.

So it’s a very important distinction that has very real implications for the potential for Dacxi Chain to redraw the lines of what’s possible for equity crowdfunding.

Andy Pickering – Host

Got it. Thank you, Ian. Another fascinating part of the potential of the Dacxi Chain, and the potential of equity crowdfunding is the ability for investors to drive impact through positive social and economic change around the world. So I’d love to get some big-picture thoughts on how you think the Dacxi Chain can help participate in driving this global positive social and economic impact?

Ian Lowe – Guest

Yeah, of course, one of the things we talk about a lot is the potential to democratize investing for everyday investors. So this is not just retail investors, though it includes retail investors, and individual everyday investors who want the opportunity to participate. They’re not going to invest in everything. They don’t have huge capacity, which of course makes crowdfunding perfect for them because they’re not like an institutional investor that is placing very large bets. They’re placing much smaller investments probably in a small portfolio of businesses they feel that they understand. And so really to this point in time, the only path to providing those investment opportunities to everyday investors is equity crowdfunding. But of course, it lacks the scale that drives participation.

And what we mean by that is providing a much richer catalog of investment opportunities where somebody that comes to that catalog will have an affinity with one or more of those investment opportunities based on their own life experience, their professional experience, all sorts of different things that are unique to them as an individual. So we need scale in both the catalog of opportunities and the pool of investors to really drive that synergy between supply and demand at scale. And so Dacxi Chain is really about providing that scale, providing the technology infrastructure to enable that scale.

And that scale by definition is this democratization of investing by giving everyday investors access to a larger pool of investment opportunities, many of which would typically only be offered to the chosen few that sit around the high net worth table where they get an inside run on the best opportunities. We believe that scaling equity crowdfunding will actually completely reimagine what’s possible and in the process, democratize investing in private companies, high-growth private companies for everyday investors.

Andy Pickering – Host

Fantastic. All right, let’s start to wrap up this episode. We’ve talked about the decentralized model of the Dacxi Chain ecosystem, we’ve talked about the network effect that will help supercharge the number of participants in the ecosystem. We’ve talked about the potential for the Dacxi Chain to drive positive social and economic impact. If you put all of this together, it starts to sound like a paradigm shift. Let’s close out this episode by explaining how we think the launch of the Dacxi Chain is a paradigm shift when it comes to equity crowdfunding?

Ian Lowe – Guest

Certainly. Today, less than 1% of the funding that finds its way into growth businesses comes out of equity crowdfunding. Now, that just has to change. And the only way it changes is through scale. And we’ve talked about this idea of empowering individuals with the opportunity to participate and to do that at scale. But think about the implications on the other side of these investment opportunities. We’re talking about founders, high-growth companies in the early stages of their life. They’ve got a proven product or a service or an offering. But to scale that business, they need access to money. They need growth capital, and they’re willing to give away some of the business to achieve that, to realize their dream.

And so on that side of all of these transactions, that’s what we talk about when we talk about the innovation economy. This is the way that capital finds its way into businesses with great ideas and great solutions that need capital to realize the benefit of those great ideas. And, of course, that benefit can now flow to everyday investors. So at scale, equity crowdfunding truly is a win where we’re not just providing access, we’re actually giving innovators access to capital. And we’re doing it in a way that gives them access to more capital, gives them access to capital faster. And we think over time, it will also start to give them access to capital at a more competitive price because of the scale.

And so all of those things in combination are not hard to project as we start to sign more platforms and build this network and see the effect of that network and its growth.

Andy Pickering – Host

Really good stuff Ian, it really is about supercharging the ability for people to innovate and get funding for those innovative ideas. It’s a really exciting time, I think. That brings us nicely to the end of episode two in our three part special series celebrating the launch of the Dacxi Chain. In our third episode, we will look at the Dacxi Chain roadmap and beyond. What is the future of equity crowdfunding? It’ll be very exciting. Please join us for episode three. But that is the end of episode two. Thank you again, Ian.

Ian Lowe – Guest

Thanks, Andy.